Here is the latest update from the Saffron Building Society. For details see their latest product information here. Lending criteria details are available here. Remember, you can access these products through our direct to lender mortgage club to get the benefits of payment on completion as well as out specialist mortgage support.

Saffron Announcement

Product launch & Criteria change 7 December 2022

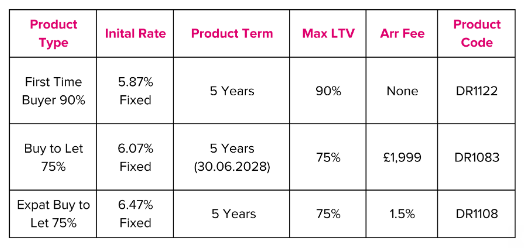

We’re continuing our phased return to the market with the launch of First Time Buyer 90%, Buy to Let and Expat Buy to Let fixed rates. These products launched today, Wednesday 7 December 2022.

You can find product details below and on our website.

Policy and Criteria Enhancements

While we paused our mortgage lending, we took the time to review our policy and documentation requirements and have made improvements based on your feedback, including the following enhancements:

- We can now consider using the applicants share of net profit after tax for self-employed limited company directors with a minimum shareholding of 50%

- Self-employed sole traders who have recently converted to limited company status no longer have to wait for 12 months trading and can be considered using their historic trading position

- For self-employed applications we now only require one month’s personal bank statements and no business bank statements as a minimum submission requirement

- For contractors we no longer require 2 years industry experience and only now require applicants to be contracting for a minimum period of three months

- Our underwriters now have discretion to consider unsettled CCJ’s and Defaults up to a maximum value of £500

For full details of our newly enhanced criteria, please visit the A-Z Guide on our website or contact the Intermediary Support Team.

On Friday, 7 December, our SVR will be increasing

Cases at or beyond FMA submitted, with fees paid (if applicable), by 5pm on Thursday 8 December will have their affordability assessed based on the current SVR (6.49%). Any cases submitted after this point will have their affordability assessed in line the new SVR (7.49%).