View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Increase to tracker pay rates

On Tuesday 4 April, the pay rates on all our new business and product transfer tracker rates are increasing by 0.25% to reflect the recent Bank of England base rate increase from 4.00% to 4.25%.

The rates and fees on our fixed rate products are not changing.

No action is required for pipeline cases.

For existing Santander and Alliance & Leicester customers who are on a base rate tracker, their rate will increase by 0.25% from the beginning of May.

Further information

Full details of our new business mortgage range can be found in Rate Bulletin (Issue 7). You’ll find this on our website from Tuesday 4 April

How to get in touch with us

Your Broker Support Team

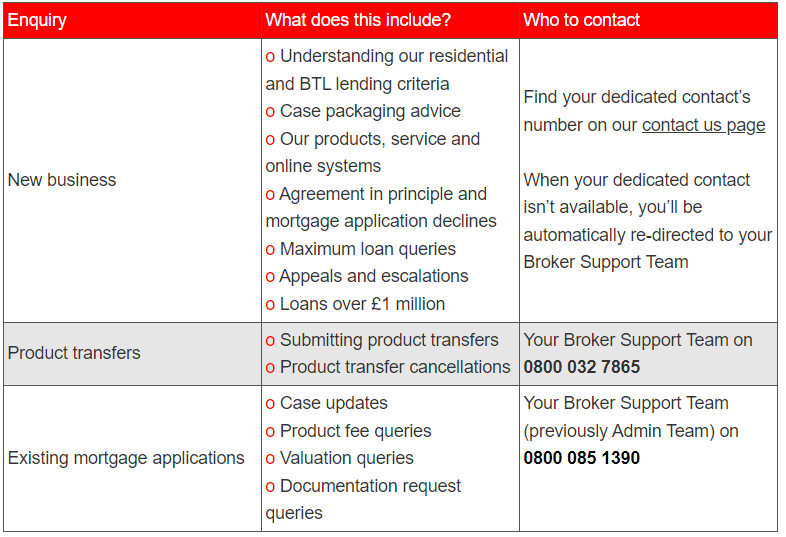

We’re pleased to announce that in addition to your dedicated contact, your Broker Support Team can help over the phone with your new business and product transfer queries, and your existing mortgage applications

Contact us

Please note our telephone numbers won’t be changing. We’ll direct you to your Broker Support Team when you call us.

Residential fixed rate reductions

On Thursday 6 April, we’re reducing selected fixed rates across the new business and product transfer ranges.

There are no changes to any Buy to Let rates in either range.

New business

- Most purchase rates reducing by between 0.04% and 0.20%, including larger loan rates

- All new build rates reducing by at least 0.05%, with under 75% LTV rates reducing by 0.15% or 0.20%

- Selected remortgage rates reducing by between 0.08% and 0.20%

- Our lowest on-sale rate will be 60% LTV, 5 year fixed rate at 3.94% with a £999 fee for purchases

Product transfers

- Selected residential fixed rates reducing by between 0.08% and 0.20%

- Please log on to our online mortgage transfer service in Introducer Internet to view your client’s choice of rates. You won’t find these on sourcing systems. If you’re happy to use an estimated LTV, you can find the full range in the product transfer rate bulletin on our latest rates page from Thursday 6 April

Further information

Full details of our new business range can be found in Rate Bulletin (Issue 8). You’ll find this on our website from Thursday 6 April