Virgin Money has announced an important product update for advisers. Virgin Money products and support with the lender, including same day payment on completion, is all available accessible through our direct to lender mortgage club. Contact us for more information.

ANNOUNCEMENTS

WE’RE INCREASING SOME RATES AND LAUNCHING NEW BTL PRODUCT TRANSFER DEALS

We wanted to let you know that we’re launching the following Virgin Money products on Wednesday 24 April.

Product Transfer BTL Fixed Rate deals with £3,995 fee

- NEW 60% LTV 2 Year Fixed Rate at 4.84%.

- NEW 75% LTV 2 Year Fixed Rate at 5.14%.

- NEW 60% LTV 5 Year Fixed Rate at 4.61%.

- NEW 75% LTV 5 Year Fixed Rate at 4.81%.

Product Transfer BTL Tracker deals with £1,995 fee

- NEW 60% LTV 2 Year Fixed Rate at 5.79%.

- NEW 75% LTV 2 Year Fixed Rate at 6.21%.

We’ll also be making the following changes at 8pm on Tuesday 23 April:

- Selected Product Transfer fixed rates will be increased by up to 0.10%, starting from 4.38%.

- 90% LTV Purchase Fix & Switch fee-saver will be increased by 0.05% to 5.52%.

- 90% LTV Professional Purchase Fixed Rate fee-saver will be increased by 0.02% to 4.82%.

- Selected Remortgage fixed rates will be increased by 0.10%, starting from 4.79%.

- 5 Year Greener New Build fixed rates will be increased by 0.05%, starting from 4.44%.

- Own New Rate Reducer 3% Incentive 2 Year fixed rates will be increased by up to 0.10%, starting from 2.57%.

- Own New Rate Reducer 5% Incentive fee will be increased by £500, to £995.

If you’re applying for one of these products on behalf of your customer, please send us the application by 8pm today.

We’ve extended our Green Reward offer

We’ve got great news about Green Reward; our sustainability initiative that rewards existing customers with £250 cashback for making green home improvements.

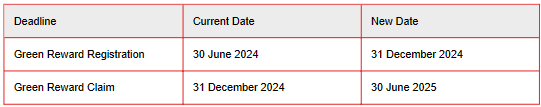

We’ve extended our deadline dates giving more customers the chance to register and claim. If one of your clients has already registered, they can also take advantage of the extended deadlines.

Green Reward is open to residential and BTL customers taking additional borrowing, or a product transfer with additional borrowing, and who then spend at least £2,500 on eligible green home improvements. This includes changes to the property that increase energy efficiency or reduce the carbon footprint. See the full terms for Green Reward.

You can find our current rates in our Product Guide. If you’ve got any questions, you can get in touch with your Business Development Manager or dedicated Mortgage Service Team.