The Skipton Building Society has released an intermediary update. For full details see their latest product information here. All Skipton products are accessible through our direct to lender mortgage club with payment on completion. Contact us for details.

Skipton Announcement

Loan to Income Cap – Update

We’re making things easier for you and as we’ve made quite a few changes recently, we wanted to remind you of our current LTI caps, and of a change which we’re making next week.

From Wednesday 3 March 2021 our LTI cap for applications greater than 85% LTV will be 4.49, all of our other LTI caps remain unaffected. Any pipeline cases and DIPs prior to 3 March will be honoured, but web calcs will not.

Our LTI limits from Wednesday 3 March are:

- Household income lower than £40,000: max 4.45

- Greater than 85% LTV: max 4.49

- Help to Buy and Shared Ownership: max 4.50

- All other residential lending: max 4.75

We're making changes to our Government scheme products

Product Update

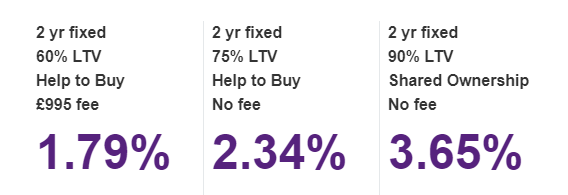

We’re making changes to our Government scheme products. Plus we’re launching two new HTB products at 60% LTV. More details of the changes can be found below, including a selection of our new rates.

Homebuyers using the current Help to Buy Equity Loan scheme now have until 31 May 2021 to complete their purchase. After that, our Help to Buy range will only be available for homebuyers using the Help to Buy England 2021–2023 scheme.

Key Changes

- Extended end dates on all Government scheme products to 31 August 23/26.

- Selected rate reductions across the Government scheme ranges of up to 0.15%.

- NEW 60% LTV options for Help to Buy and Help to Buy (England) 21-23 to help customers in London where the government equity loan is up to 40%.

- Increased rates on the residential core range 10 year fixes of 0.10%

Please note that in line with our commitment to endeavor to provide two working days’ notice of product withdrawals, current equivalents will be withdrawn at 10.00pm Tuesday 2 March.