Below is an update from West One, the Bridging, BTL, Commercial, and Seconds Mortgage lender, that you can access via our specialist mortgage team. Contact our team today for more information.

Announcement

Buy-to-Let: Important Product and Criteria Changes

We are writing to update you on some exciting changes to our product range effective from 4th April 2023. The revised product range will be available for selection on our broker from this day.

We are pleased to announce the launch of a new lower rate range of Limited Edition 5-year and 2-year fixed rates for Non-portfolio Landlords. We are also lowering rates across most limited-edition Standard and Specialist products.

A summary of the changes is noted below:

Product changes

- New Limited Edition 5-year fixed Non-Portfolio W1 Standard with rates starting from 4.64%.

- New Limited Edition 5-year fixed Non-Portfolio W1 Specialist with rates starting from 4.71%.

- Existing Limited Edition 5-year and 2-year fixed W1 Standard and Specialist rates reduced above 55% LTV.

- Core Discount Tracker products withdrawn.

New Product Guide

An updated product guide incorporating these changes is available here.

Pipeline

Core Discount Tracker cases need to be offered by close of business Tuesday 16th May 2023. In order to meet this deadline, it is advisable to ensure the application, along with application and valuation fees, are submitted promptly so the case can begin the underwriting process.

Registration

If any of your colleagues would like to register to become an introducer to West One BTL, please provide them with this link:

Please get in touch if you would like any support or training on submitting a case and we will arrange a training session.

If you have cases to discuss or require any further information, please contact your BDM or the broker support team on

0333 123 4556 or email btlbrokersupport@westoneloans.

Residential Mortgages Update – Rate and lender fee reductions

We are delighted to announce a series of major pricing reductions to our range of fixed rate residential mortgage products and in addition all products will benefit from a fixed lender fee with effect from Thursday 6th April.

Prime Plus

Fixed rates reduced by up to 1.11%

5 yr fixed rates now starting from 6.24%

2 yr fixed rates now starting from 6.49%

Prime Plus Flex (LTI’s over 5 times income) now starting from 6.99%

Lifetime tracker products have increased and are now starting from 7.24%

Near Prime

Fixed rates reduced by up to 1.06%

5 yr fixed rates now starting from 7.64%

2 yr fixed rates now starting from 8.24%

Lifetime tracker products increased to 8.49%

Prime

Fixed rates reduced by up to 1.06%

5 yr fixed rates now starting from 6.64%

2 yr fixed rates now starting from 7.24%

Prime Plus Flex (LTI’s over 5 times income) now starting from 7.39%

Lifetime tracker products have increased and are now starting from 7.75%

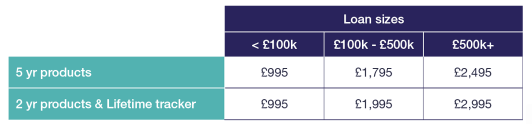

Introduction of Fixed Lender Fees

We are introducing a new fee structure applicable to our full residential mortgage product range as follows which will generate lower fees for a significant proportion of borrowers:

Commission payable will be 0.75% of the net loan amount for all products and will be capped at £4995.

You can find full details of our latest rates and improved lender fees in our updated product guide dated 6th April 2023.

Pipeline Cases

We will honour pipeline cases where a valid unexpired ESIS has been produced prior to close of business today and is offered by Friday 5th May 2023.

We believe these changes will provide greater opportunities for you to place increased numbers of applications with West One and our helpful broker support and sales team are on hand to assist with any new cases you would like to discuss:

T: 0333 1234 556