Announcement

We have PROduct news! – PROducts for PROfessionals, by PROfessionals

We’re delighted to announce some new changes to our proposition that will be live from 5.30pm on Monday 7 August 2023.

We continuously strive to deliver innovative solutions, and these PROduct improvements have been designed specifically for PROfessionals, by PROfessionals. In an ever-evolving market, where property investors have differing business strategies, we want to provide you with more tools to support your diverse client base.

Introducing our new 2 year and 10 year fixed rates

Flexibility and choice has never been more important so we are launching new 2 and 10 year fixed rates across our Complex Buy-to-Let and Commercial Investment mortgage propositions.

- Our 2-year fixed rate provides a shorter commitment option for investors seeking flexibility. Rates start at 6.69% for Complex Buy-to-Let and 7.24% for Commercial.

- While our 10-year fixed rate supports those investors who are seeking longer-term security, with rates starting at 6.39% for Complex Buy-to-Let and 6.94% for Commercial.

Affordability for 5 and 10 year fixed rate products can be calculated at payrate.

For our variable, 2 and 3 year fixed rate products our stress rate will now be added to the product payrate rather than our variable rate. This change will enable up to 20% more leverage for short term fixed rates when compared to today.

Alongside the introduction of these new fixed rates, we have repriced across some of our Buy-to-Let and Commercial Investment products.

The latest version of our product guide, which reflects all of these product changes, is available to download.

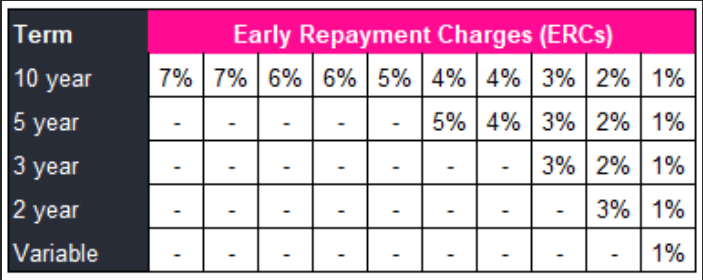

New format to Early Repayment Charges (ERCs)

We know flexible products are more important than ever so we’ve revised our ERCs to link them to the fixed rate period rather than the loan term alongside a small first year fee for our variable rate product.

Product Switch/Refinance fees & ERCs

Product switch and refinance arrangement fees will increase from 1.5% to 2%.

We know raising capital is the lifeblood of a growing property investment business. Our current offering to waive the ERCs for existing Shawbrook loans being refinanced to a new product remains available where capital is being raised. We are introducing a definition of a capital raise which must be at least a 10% increase in the original loan amount subject to a minimum of £20k additional lending.

For capital raises that are smaller than this or like-for-like (£ for £) refinances, ERCs are chargeable.

Importantly, on our new 10 year fixed rate product we cannot waive any ERCs in the first 5 years even for a capital raise.

Please remember that while the above is our current offering, this could change at any point in the future and contractually ERCs apply as per the customer’s loan agreement.

Important information on pipeline

As a reminder, all Indicative Mortgage Offers (IMOs) must progress to valuation within 14 days and all Formal Mortgage Offers (FMOs) must be signed and returned within 14 days in order to remain valid. FMOs are valid for 90 days

For the changes to ERCs, all new FMOs issued from Tuesday 8 August 2023 will be on the new fee structure.

For cases where we are relying on AVMs, all case documents must be uploaded within 30 days. After this time the case will be cancelled and new pricing will apply.

Any cases that proceed outside of those timeframes, as published on the IMO and FMO documents, will proceed on the new rates (if applicable).

Latest guides

Please download our updated product guide for accurate information.

A reminder that these guides are live from 5.30pm on Monday 7 August 2023