Accord Mortgages have released an update on their product range, the details are set out below. Accord products are available through our direct to lender mortgage club so contact us for more information on how our club can support your business.

We’re making changes to our Buy to Let New Business product range

We appreciate the market is volatile at present, and whilst not always possible, we will endeavour to give you at least 24 hours’ notice of any upcoming changes.

On Thursday 5 September, we’re making changes to our Buy to Let New Business product range. The current range will be withdrawn at 10pm Wednesday 4 September and the new range will be available at 8am Thursday 5 September.

What’s changing?

- ERC Free fixed rate product products are being withdrawn

- End dates are being extended to the end of January.

What else do you need to know?

Please note that a full mortgage application must be submitted by the time of withdrawal to secure a new lending product. If you are yet to submit a DIP, please do so as soon as possible as any referrals will only be looked at during normal office hours.

For Buy to Let applications, the product selected will impact the maximum loan we can offer. As a product cannot be selected at DIP stage, it is important that you use our rental calculator which can be found here as this allows you to input the details of the product required and provide you with a more accurate maximum lending amount. The actual maximum lending available will be determined at the point you submit a Full Mortgage Application.

Buy to Let New Business Product Finder

Great news! We’ve improved our New Build Affordability assessment

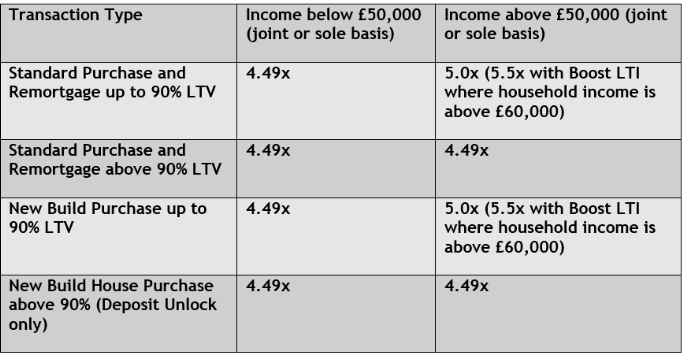

At Accord we’re always looking for ways to help you help more clients. And as we are a common-sense lender, we’re pleased to let you know that from today we’ve enhanced our affordability assessment to:

- Reduce the minimum household income threshold for lending above 4.49x LTI (up to 5x LTI) to £50,000 (from £60,000), for LTVs up to 90%.

- Increase our new build LTV to 90% (from 85%) for above 4.49x LTI (up to 5x LTI) where the household income is £50,000 and above.

- Increase our new build LTV to 90% (from 85%) for Boost LTI where the household income is £60,000 and above.

How does it work?

The good news is you don’t need to do anything differently. Simply visit our website here and use our online calculators or submit your DIP as normal – MSO will do the rest.

What else do you need to know?

- Standard Lending policy and affordability must be met

- The minimum income threshold for Boost LTI will remain at £60,000

- Not available for applications using the New Build Deposit Unlock scheme

You can view our LTI criteria below: