Accord Mortgages have released an update on their product range, the details are set out below. Accord products are available through our direct to lender mortgage club so contact us for more information on how our club can support your business.

Upcoming changes to Accord Residential New Business product rates

Accord are making a number of changes to their Residential New Business product rates.

The current range will be withdrawn at 8pm on 10 May and the new range will be available at 8am on 11 May.

What’s changing?

Selected fixed rate products increased:

- 60% LTV increased by between 0.10% to 0.15%

- 75% LTV increased by between 0.08% to 0.15%

- 80% LTV increased by between 0.08% to 0.15%

- 85% LTV increased by between 0.10% to 0.25%

- 90% LTV increased by between 0.05% to 0.18%

- 95% LTV increased by between 0.03% to 0.15%

Other changes:

- Introduction of 2 and 3 year products at 95% LTV

- Selected cashbacks either reduced by £250, or removed

- End dates extended until 30 September.

What else do you need to know?

Please note that a full mortgage application must be submitted by the time of withdrawal to secure the product.

When is this change?

The current range will be withdrawn at 8pm on 10 May and the new range will be available at 8am on 11 May.

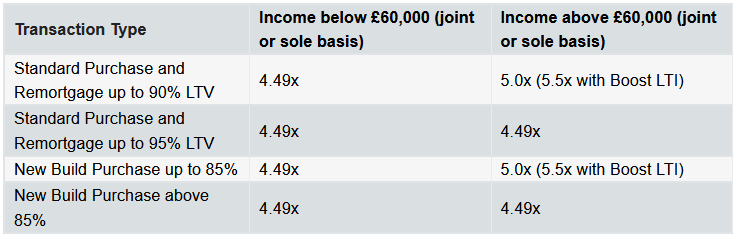

Great News! Accord have reduced their minimum income threshold for clients who need more than 4.49x LTI

Common sense lending, it’s what Accord does. So, from today Accord have reduced the minimum household income threshold for lending above 4.49x LTI to £60,000 (from £70,000), for LTVs up to 90% (85% for new build) including the Boost LTI range.

Who’s it for?

This change will help you help even more clients, by providing more flexibility to achieve their borrowing goals – helping first-time buyers and those looking to move up the property ladder or remortgaging.

How does it work?

The good news is you don’t need to do anything differently. Simply visit Accord’s website here and use their online calculators or submit a DIP as normal – MSO will do the rest.

What else do you need to know?

- Applies to the Boost LTI range

- Standard Lending policy and affordability must be met

- Not available for 90.01% – 95% LTV, the New Build Deposit Unlock scheme or New Build 85.01% to 90% LTV

- Cascade score applications are not included

You can view Accord’s LTI criteria below