Accord Mortgages have released an update on their product range, the details are set out below. Accord products are available through our direct to lender mortgage club so contact us for more information on how our club can support your business.

Accord is lowering their rental calculation for straight switch re-mortgaging where no additional capital is being raised

To further demonstrate Accords commitment to the Buy to Let market they’re introducing a lower rate rental calculation from today, available for straight switch re-mortgages where no additional capital is being raised.

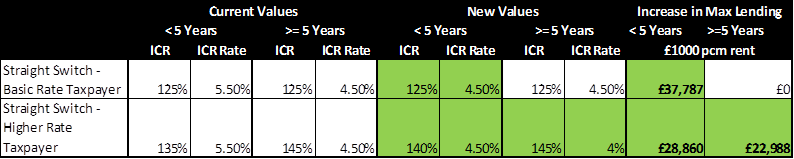

The new ICR/ICRR rates are as follows:

Basic & Zero Rate Taxpayers – £for£ re-mortgage

All Products – 125% @ 4.5%

Higher & Additional Rate Taxpayers – £for£ re-mortgage

< 5-year products – 140% @ 4.5%

>= 5-year products – 145% @ 4.0%

The higher of the above ICRR rates or product rate + 2% for <5-year products and product rate + 1% for >= 5-year products will apply.

All other ICR/ICRR rates remain unchanged and can be found here. Alternatively, brokers can use the handy Accord rental calculator.

When choosing Accord you can be sure you’ll get the Buy to Let service you need to support your landlord clients, all backed up with their promise to look at your cases with good old common-sense in mind.

So, next time you have a Buy to Let client, give Accord a go and be confident you’ll get a Buy to Let lender, not just a lender that does Buy to Let.

Product Launches

Residential – Accord have launched a new Product Transfer and Additional Loan range, with cashback incentives included in selected Product Transfers.

BTL – Accord have increased rates across their Buy to Let Product Transfer range from Friday 29th April, with rates increased by between 0.10% – 0.40% across all LTVs.

Click here for Residential and here for BTL to see Accord’s up to date product ranges.

BTL IRC

Accord Mortgages has improved the interest coverage ratio (ICR) and interest coverage reference rate (ICRR) for landlords remortgaging where no additional capital is being raised, as part of ongoing enhancements to its buy to let offering.

From today (27 April), the lender’s new ICR rates for brokers whose landlord clients wish to do a like-for-like remortgage are:

- 125% at a stressed rate of 4.50% for basic and zero rate taxpayers, applicable to all products

- 140% at a stressed rate of 4.50% for higher and additional rate taxpayers choosing less than five-year product

- 145% at a stressed rate of 4.00% for higher and additional rate taxpayers choosing a five-year or longer product

All the lender’s other ICR/ICRR rates remain unchanged.

For more information on Accord’s BTL lending, click here

Accord are increasing rates across their Buy to Let Product Transfer range and extending end dates

Applies to: Buy to Let Product Transfers

Accord are increasing rates across their Buy to Let Product Transfer range. Existing products will be withdrawn at 6pm on Friday 29th April and replaced at 6pm on Friday 29th April.

What’s changing?

- Rates will increase by between 0.10% – 0.40% across all LTVs

- End dates are being extended

What’s staying the same?

- Nothing – all products are changing

When is this change?

- Existing products will be withdrawn at 6pm on Friday 29h April and new products will be available from 6pm on Friday 29th April.

Accord are launching a new Residential Product Transfer range with cashback incentives and making changes to their wider Residential Product Transfer and Additional Loan ranges

Applies to: Accord Residential Product Transfers and Additional Loans only

Accord are delighted to share an exciting new product transfer range with you!

Accord knows that being able to offer more choice is important to your brokers when they’re recommending products to their clients, and they pride themselves on bringing new products and easier processes to fit clients’ needs.

So, from Friday 29th April Accord are introducing a new product transfer range with cashback incentives (alongside wider product changes) to help your brokers do just that!

What’s changing?

- Accord’s new product transfer range will include cashback on selected products across a range of LTV bands and will be available to all clients.

- Payment is fully automated, so your brokers and their clients don’t need to do anything to receive it!

- On completion, cashback is paid directly into the client’s bank account if they pay by direct debit. And if they don’t pay by direct debit, Accord will contact them within a week of completion to arrange payment.

For more information on cashback payments for different mortgage parts and product codes, please click here.

What’s the product range?

Cashback products

- 12 new products are being launched across 65%, 75%, 80% and 85% LTVs

- £100 cashback available at

- 65% LTV – 2 year term and 5 year term

- 75% LTV – 2 year term and 5 year term

- £250 cashback available at

- 65% LTV – 2 year term and 5 year term

- 75% LTV – 2 year term and 5 year term

- 80% LTV – 2 year term and 5 year term

- 85% LTV – 2 year term and 5 year term

- £100 cashback available at

Please note, these products will be available to anyone within their product transfer window, provided they have not already accepted a product transfer that’s awaiting completion.

Accord are also making changes to their other Product Transfer and Additional Loan products (excluding cashback)

- 67 product rates are increasing by up to 0.30% at all LTVs up to 90% LTV

- 7 products are staying the same at 95% LTV and above.

When is this changing?

Accord’s current product range will be withdrawn on Thursday 28th April at 8pm, and their new product range will be available from Friday 29th April at 8am.