Afin Bank has updated its product and criteria, the details are below. These products are available through our direct to lender mortgage club so contact us for more information on how our club can support your business.

For high-net-worth clients, remortgaging can be a strategic decision made to unlock capital, rebalance wealth, and create flexibility without disrupting long-term plans.

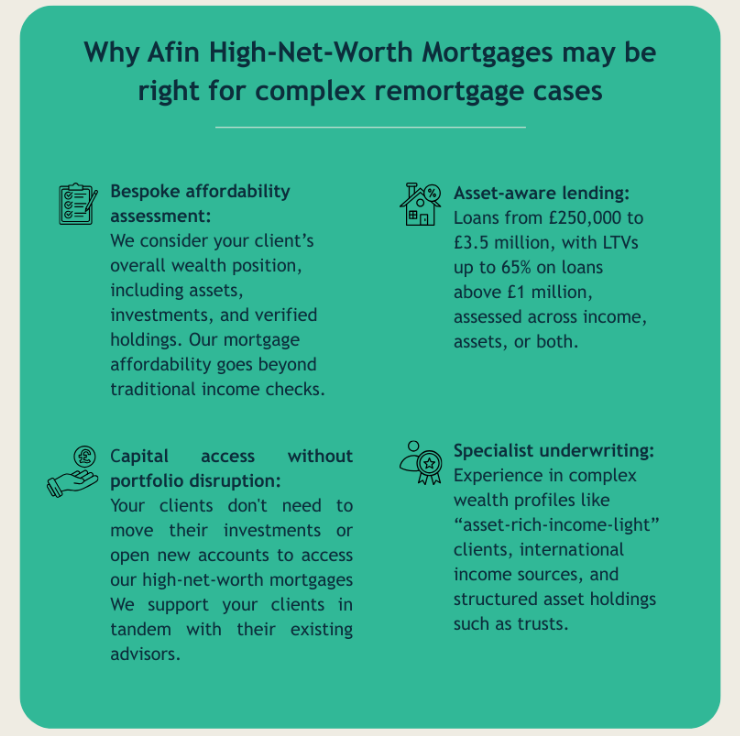

Introducing Afin High-Net-Worth Mortgages, ideal for remortgage scenarios where wealth often sits as much in assets as it does in income.

Whether your client is a like-for-like remortgage, or raising capital, we can support the release of funds* from an existing property to meet a wide range of objectives.

These may include an element of debt consolidation, property investment (including buy-to-let), business investment such as capital injection or expansion, education costs including private school or university fees, and tax liabilities such as inheritance tax or one-off tax bills.

We assess mortgage affordability using assets or income or a combination of both – leveraging wealth meaningfully and aligned with your true financial standing.