Here are the latest updates from Barclays. These products are available via our direct to lender mortgage club which offers you payment on completion and a lot more besides!

Improved Loan to Income (LTI) multiples

Following on from the confirmation that we have moved from a hard credit footprint to a soft credit footprint before submission of your client’s application, we’re now delighted to confirm two enhancements to our LTI policy that will help more of your clients seeking a mortgage with Barclays.

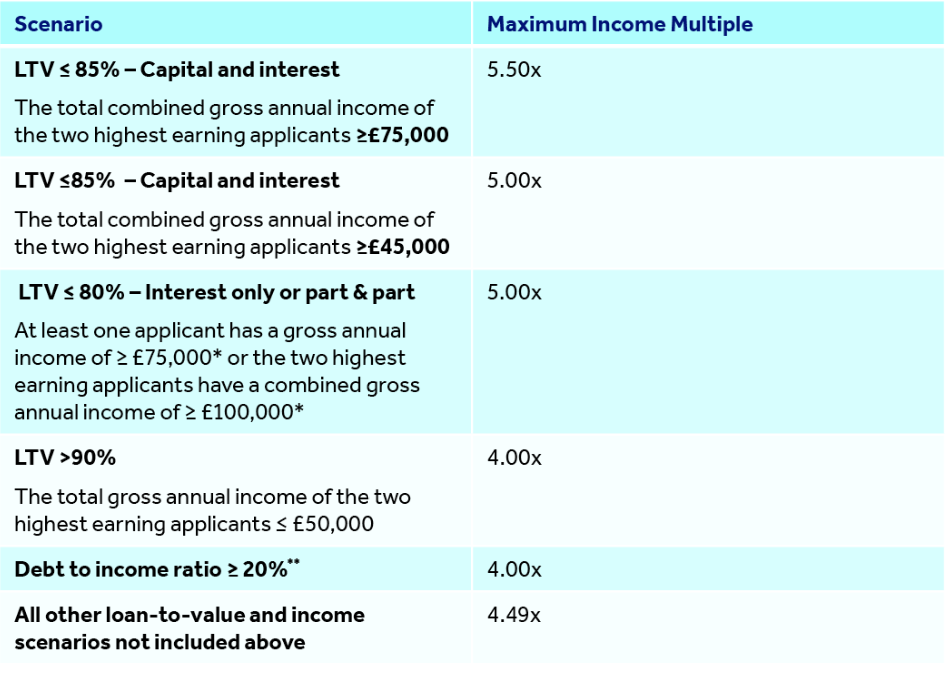

The following updates will now apply based on income.

- Joint customers with £75k-£100k joint income, ≤85% LTV, will access 5.50x LTI up from 5.00x

- Customers with £45k-£60k joint income, ≤85% LTV, will access 5.00x LTI up from 4.49x

These limits will be automatically applied to all residential lending decisions from today, Thursday 26th October.

Our updated LTI table

Please click here if you are unable to view the image above

Explore our full lending policy here

Barclays mortgage product changes

We are pleased to confirm we are further reducing rates by as much as 26 basis points on a selection of products across our Residential Purchase and Reward ranges, effective from tomorrow, Wednesday 1 November.

Key residential purchase product change highlights

- Reduced –2 year Fixed 899 product fee, 60% LTV, Min loan 5k, Max loan 2m will be reducing from 5.36% to 5.10%

- Reduced – 2 year Fixed 899 product fee, 75% LTV, Min loan 5k, Max loan 2m will be reducing from 5.42% to 5.20%

- Reduced – 2 year Fixed 899 product fee, 85% LTV, Min loan 5k, Max loan 2m will be reducing from 5.92% to 5.72%

For more information, including details of one product withdrawal, please view our rate overview guide and you can access the full range of Barclays mortgage products, effective from tomorrow, within our updated intermediary and Reward rate sheets.

Product withdrawal timings

To qualify for a product, a MIS needs to have been generated, on or before the date of withdrawal (Tuesday 31 October) either using our Barclays systems or your preferred sourcing tool and must be submitted prior to the last application date Wednesday 1 November for Product Transfers and Thursday 9 November for new lending applications.

Please be advised that upon withdrawal, the products will be removed from the dropdown options within our application services. Therefore, for new lending applications you will need to ensure the product has been selected and saved in the application today (you then have until Thursday 9 November to secure a case booking and submit).