Here are the latest updates from Barclays. These products are available via our direct to lender mortgage club which offers you payment on completion and a lot more besides!

Barclays Mortgage product changes

Please be advised we’re making a number of changes to products within our Residential New Lending ranges, effective from tomorrow, Thursday 21st July, 2022.

Full details of all changes – including confirmation of new products that are launching – are available by viewing our rate overview guide.

Important reminder – for any existing product that is changing, you have nine days to submit an application on the current product provided you have followed the specific guidance below.

Action required today to secure a rate:-

Generate a MIS

- You need to have a Mortgage Information Sheet (MIS) generated for the loan required on the required rate, dated (at the latest) today – Wednesday 20th July 2022.

- Note – You can generate a MIS either using our Barclays systems or your preferred sourcing tool.

Select and save the rate

- You must also ensure you have selected and saved the required product within our application systems today, as it will not be available for selection from tomorrow

Action required by last application date, Friday 29th July:-

Secure a case booking

- To successfully submit the application you will require a case booking in our application system and you have until Friday 29th July to book your case and submit.

Important Valuations and Cladding Updates

We’re pleased to share the launch of new case tracking functionality for property valuations and signpost future changes that we’re working towards relating to lending on properties with cladding.

Valuation status updates now available in case tracking

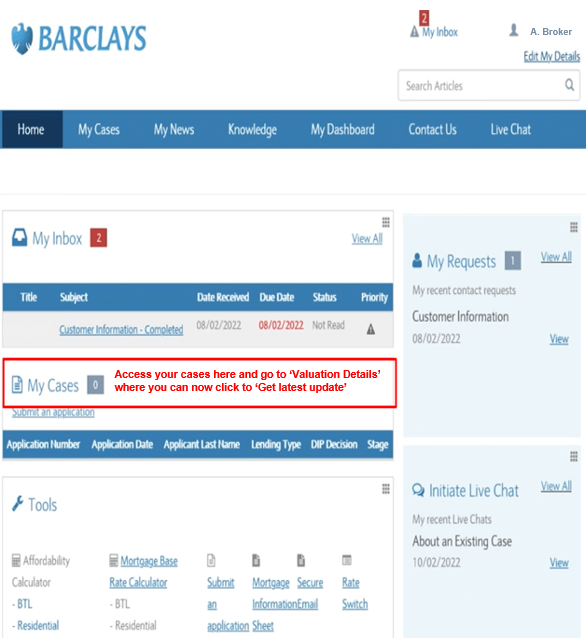

Your feedback has told us you need greater clarity over the status of a valuation and we are pleased to confirm that you are now able to access this information within our case tracking tool which is accessible from the my case section on the homepage of the Barclays intermediary HUB.

Moving forward, as well as being able to access speedy updates on other questions relating to a submitted application, you are now able to get real time confirmation of when the valuation appointment has been booked and then again when the valuation has been completed, removing the need for you to contact us for updates.

Login to the Barclays intermediary HUB to access the case tracking tool today

You may have seen recent reports in the media on the latest developments relating to lending on properties with fire safety defects, outlining that six lenders, including Barclays, have committed to lend on properties with cladding that are entitled to Government funding to fix existing fire safety faults.

We are delighted to confirm our support to this group of customers who have, until now, been unable to sell or buy an impacted property. We’re currently working through the updates needed to meet this commitment and we look forward to sharing more detail in due course.