The latest update from Family Building Society can be found here. Remember, we are able to package on a fees free basis for Family Building Society and also offer support to brokers who wish to deal directly via our mortgage club. Further details are available across our website. Full details of product range here.

Important information on our mortgage products

From today, Thursday 5 October, we’ve made a number of changes across our mortgage range including rate reductions across all our fixed rate products.

Owner Occupier – new 2 Year Fixed rate products now on sale:

Repayment

- New Core range products start from 6.24%, up to 60% LTV

- New JMSO products start from 6.44%, up to 60% LTV.

Other 2 Year Fixed rate repayment (Core range and JMSO) products have been launched, up to 80% LTV.

Interest-Only

- New Core range product at 6.89%, to a maximum 60% LTV.

Owner Occupier product changes – all 5 Year Fixed rate products have been reduced:

Repayment

- Core range products – rates now start from 5.54% up to 60% LTV*

- JMSO products – rates now start from 5.74% up to 60% LTV*

- Family Mortgage – now at 5.79%, up to 95% LTV (additional security required).

*Other products available up to 80% LTV.

Interest-Only

- Core range product – now at 6.19%, to a maximum 60% LTV

- Retirement Interest-Only (RIO) – reduced to 6.49%.

Buy to Let product changes – all 5 Year Fixed rate products have been reduced:

- UK Landlords – rates now start from 6.14% up to 60% LTV*

- Limited Company SPVs – rates now start from 6.14% up to 60% LTV*

- Expats – now at 6.59% up to 70% LTV, on an Interest-Only basis.

*Other products available, up to 70% LTV.

Managed Mortgage Rates

Please note that our Managed Mortgage Rates are not changing at this time.

Semi-exclusive products

On top of our standard range of products we have additional semi-exclusive products available via our packaging partners. For further information, speak to your local BDM

See full details of our new product range here

We have a team of BDMs ready, willing and able to answer any of your queries and guide you through the application process. If you don’t have a BDM in your area, you can contact our dedicated Mortgage Desk

Great news on our proc fees!

From today, Thursday 5 October we’re increasing proc fees for product transfers – matching what we pay for new business.

We appreciate the hard work that you, our intermediaries, do in this ever-changing interest rate environment.

With the new Consumer Duty regulations, we recognise that product transfers are becoming more and more complex. We feel you should be rewarded for the additional work this entails, especially in what continues to be a difficult market for many.

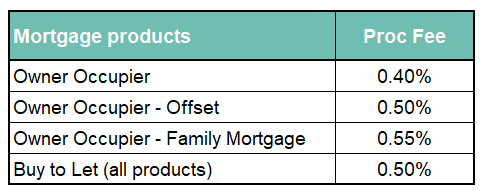

Our new product transfer fee scale (for directly authorised introducers and appointed representatives) is as follows:

Further information is available on our website, including our newly increased proc fees for submissions through mortgage clubs.

Why choose us

- No ‘computer says no’ underwriting – We’ll listen to your clients’ stories and our human underwriters make a common-sense assessment based on the merits on each individual case.

- No credit scoring – We offer tailored credit checks, taking a holistic view of your clients’ finances, not just assessing a predefined set of criteria.

- We lend to older clients – Unlike many mainstream lenders, we’ll offer mortgages to people approaching or in retirement and will consider many sources of income such as pension pots.

We have a team of BDMs ready, willing and able to answer any of your queries and guide you through the application process. If you don’t have a BDM in your area, you can contact our dedicated Mortgage Desk.