The latest update from Family Building Society can be found here. Remember, we are able to package on a fees free basis for Family Building Society and also offer support to brokers who wish to deal directly via our mortgage club. Further details are available across our website. Full details of product range here.

Important information on our mortgage products

On Friday 22 November 2024, we’ll be making changes to our mortgage product range. This includes increases across our Fixed Rate products for Owner Occupier and Interest-Only, as well as Buy to Let.

Additionally, our Professional Mortgage product will be withdrawn, and we’ll be launching a new 5 Year Fixed Rate Expat product and a new 2 Year Fixed Rate Joint Borrower Sole Proprietor (JBSP) product.

Full details of the new product range will be announced on Friday 22 November 2024.

For the withdrawn products, we’ll still accept applications through our Mortgage Hub, or by paper, up to 5pm on Friday 22 November 2024. This means that any paper applications will need to be fully completed and sent to us ahead of this deadline in order to be received in time.

We have a team of BDMs ready, willing, and able to answer any of your queries and guide you through the application process. If you don’t have a BDM in your area, you can contact our dedicated Mortgage Desk

Important information on our mortgage products

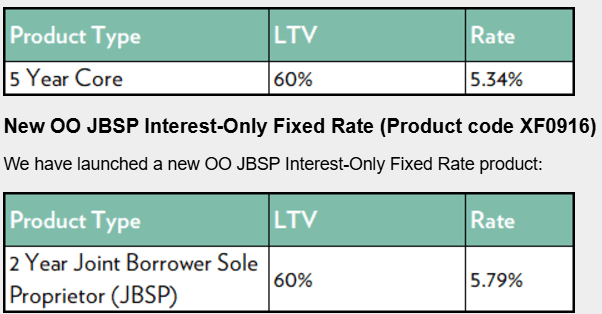

From today, Friday 22 November, we’ve launched a new range of Owner Occupier and Buy to Let Fixed Rate products. The updated product range includes increases to our Owner Occupier Fixed Rate Repayment and Interest-Only products, as well as our Buy to Let Fixed Rate products. Additionally, we have withdrawn our Professional Mortgage product, and launched new 5 Year Fixed Rate Expat and 2 Year Fixed Rate JBSP products. Further details are below:

Owner Occupier Fixed Rates

The following Repayment and Interest-Only Fixed Rate products have increased.

Repayment

Interest-Only

- Product Fee: £599

- Application Fee: £175

- Minimum loan amount of £45,000

- Maximum loan amount of £500,000

- £500 cashback for remortgage applications.

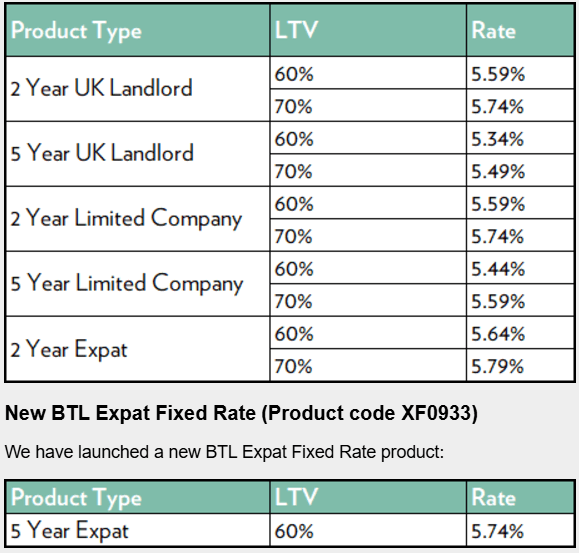

Buy to Let Fixed Rates

The following UK Landlord, Limited Company and Expat Buy to Let Fixed Rate products have increased.

- Product Fee: 1.00%

- Application Fee: £175

- Minimum loan amount of £45,000

- No maximum loan amount

Semi-exclusive products

On top of our standard range of products we have additional semi-exclusive products available via our packaging partners. For further information, speak to your local BDM.