Foundation Home Loans has updated its range across the direct to lender and packaged range. Brilliant Solutions offers fees free packaging across the range as well as direct to lender access with payment on completion.

FOUNDATION HOME LOANS CUTS 85% AND 90% LTV FIXED RATES

We are pleased to advise of price cuts of 0.15 percent to Foundation Home Loans two- and five-year fixed rates at both 85% LTV and 90% LTV levels within the F1 (near mainstream) core residential range, available immediately. [Rate guides]

2-year fixed rates reduced by 15bps, now:

- 3.84% at 85% LTV with £995 fixed product fee

- 4.64% at 90% LTV with no product fee

5-year fixed rates reduced by 15bps, now:

- 4.04% at 85% LTV with £995 fixed product fee

- 4.84% at 90% LTV with no product fee

These new rates are available to first time buyers and non-first-time buyers, for purchase or remortgage.

For the latest rates or to find out more about Foundation’s specialist mortgages for owner occupiers, visit [Foundation Residential Mortgages].

Why use Foundation for your next specialist residential case?

- For Self-employed – directors, partners and contractors; retained profits considered

- Employed – no minimum term in current job (minimum 3 months employed)

- Clients with multiple and unusual income sources

- Lower credit scores

- First time buyers

- No minimum income

- Maximum loan £2m

- Maximum term 40 years and maximum age 75 at end of term

- Maximum number of applicants is 4 (immediate family)

- Capital and interest repayment mortgages up to 90% LTV

- Capital raising for buy to let purchase accepted

- Part and part up to 80% LTV

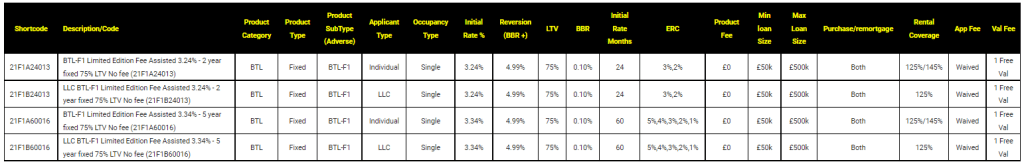

Limited Edition Product Withdrawal notice

Foundation Home Loans will withdraw the below 4 Limited Edition products at close of play, Friday 3rd December 2021.