Here is the latest release from Kensington. Remember we offer these products via Fees Free Packaging or direct to lender. For product details see their Residential Product Guide or their BTL Product Guide.

Consumer Duty rules update

As one of our valued partners, you may be aware that the FCA’s Consumer Duty rules require us to have conducted a fair value assessment of our products by 30th April 2023. Ahead of this date, we wanted to share the resulting information with you in readiness for conversations you may be having with your broker partners and to enable you to complete your review with ample time.

We have worked with UK Finance, the Building Societies Association, the Association of Mortgage Intermediaries, and the Intermediary Mortgage Lenders Association to produce a Broker Information Sheet to provide you with the results of our mortgage fair value assessments, which help you to:

- understand the characteristics of our products;

- understand the identified target market;

- consider the needs, characteristics and objectives of any customers with characteristics of vulnerability;

- identify the intended distribution strategy; and

- ensure the product will be distributed in accordance with the target market.

The Broker Information Sheets will allow you and your brokers to meet their obligations under the Consumer Duty rules which are applicable from 31st July 2023. These can be accessed by selecting the relevant sheet here.

Product Update

New products are now available, including:

Residential Select 95% LTV

These products are available to purchase applications only, with a max loan size of £350,000.

- 95% LTV, 2 year & 5 year, 6.89%, £1299 fee

- 95% LTV, 2 year & 5 year, 7.49%, no fee, free val

BTL Core Special

75% LTV, 5 year, 4.69%, 3% fee, (available to LTD Co applications too)

BTL Tracker Special

75% LTV, 2 year, 4.70% (KSR + 0.35%), 3% fee, (available to LTD Co applications too)

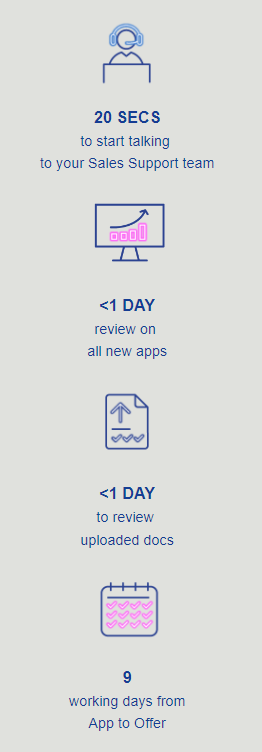

Latest service levels and Consumer Duty rules update

Consumer Duty rules update

As you may be aware, the FCA’s Consumer Duty rules require us to have conducted a fair value assessment of our products by 30th April 2023. As a result, we have worked with UK Finance, the Building Societies Association, the Association of Mortgage Intermediaries, and the Intermediary Mortgage Lenders Association to produce a Broker Information Sheet to provide you with the results of our mortgage fair value assessments, which will help you to:

- understand the characteristics of our products;

- understand the identified target market;

- consider the needs, characteristics and objectives of any customers with characteristics of vulnerability;

- identify the intended distribution strategy; and

- ensure the product will be distributed in accordance with the target market.

The Broker Information Sheets will allow you to meet your obligations under the Consumer Duty rules which are applicable from 31st July 2023. They can be accessed by selecting the relevant Sheet here

Product Update

As of close of business Thursday 27th April we will be withdrawing the following products:

- All Residential Select 70% LTV

- All BTL 5 Year Specials

- Residential Large Loan Special

Please note to secure a one of the above mentioned products you must have confirmed all DIP data is correct on the first page of the Full Mortgage Application and have commenced to the next page. If this has not been done then you will not have secured a current rate. Please see the submission deadlines below:

- Decision in Principle Illustration produced AND the Mortgage Application commenced by 5pm Thursday 27th April

- Full Mortgage Application submitted by 5pm on Wednesday 3rd May

To view our full range of products please see the product guides below.

Please note, for applications from Northern Ireland, these are subject to product availability, maximum LTV is 80% with £500k maximum loan size and no free legals apply.