Covering Residential Mortgages, BTL, Secured Loans and Bridging Finance; all of the Precise Mortgage products are available via our specialist packaged team and our direct to lender mortgage club.

Landlord customer need support with an EPC C+ refurbishment project?

If your landlord customer needs support in carrying out refurbishments to a property that already has an EPC rating of C or above, or will be awarded a C rating as a result of the work, our refurbishment buy to let proposition offering could be ideal.

Our range features an exit product with rates from 5.59% which is designed for energy efficient properties where customers want to carry out further improvements.

- Suitable for refurbishment of properties that already have an EPC rating of C or above, or will be awarded a C rating as a result of the work*

- Bridging rates from 0.64%

- Buy to let exit rates from 5.59%

- Could help to maximise rental yields and optimise capital value

*If your customer selects an EPC C+ exit, they’ll need to arrange a new EPC for the property. This must show an EPC rating of C or above.

To find out more, speak with your business development manager or get in touch with a member of our dedicated underwriting team on 0800 116 4385.

Customer looking for new ways to manage their monthly mortgage repayments?

With around 1.8 million fixed rate mortgage deals scheduled to finish in 2023, hundreds of thousands of home owners will be searching for a new product in the coming months*.

And with the cost of living continuing to squeeze people’s household budgets, many of them may be looking for new ways to manage their monthly repayments.

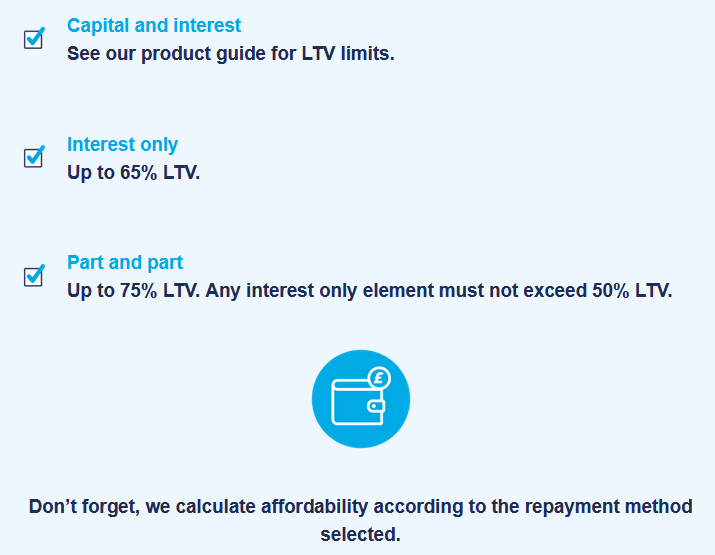

As one of the UK’s leading specialist lenders, we offer a range of options to help your customers keep on top of their cash flow.

Take a look at our criteria guide for full details >>

Download our residential mortgage guide >>

For more information about how we could help, speak with your business development manager, call our dedicated support service on 0800 116 4385 or contact us on Live Chat.

How Precise Mortgages’ are meeting Consumer Duty

On Monday 31 July, the Financial Conduct Authority (FCA) is introducing Consumer Duty which sets higher and clearer standards of customer protection across the financial services industry.

The Duty requires all of us to consider the needs, characteristics and objectives of our customers – including those with vulnerabilities – and how we behave, at every stage of the customer journey.

Precise Mortgages’ have created a Consumer Duty Hub which outlines the roles and responsibilities expected of us. You’ll also find details about what we’re doing as a business to meet them and provide good outcomes for your customers, as well as copies of our fair value assessments.