View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Santander rates update

Changes to new business and product transfer rates

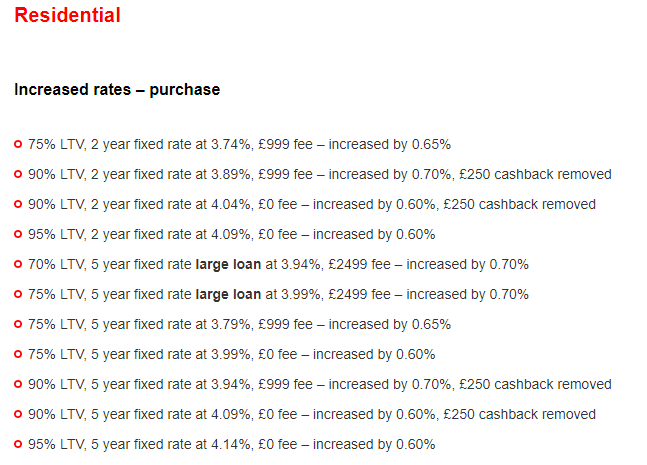

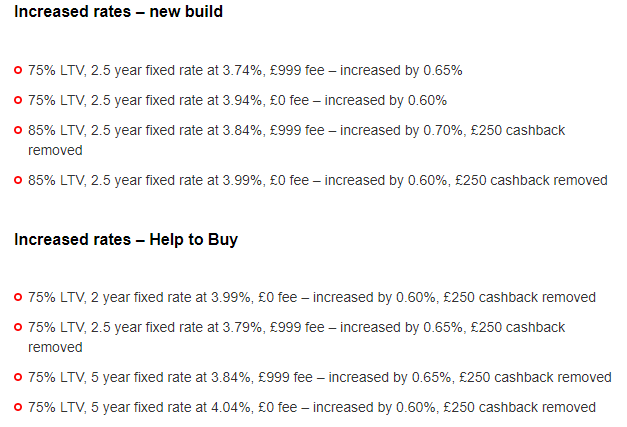

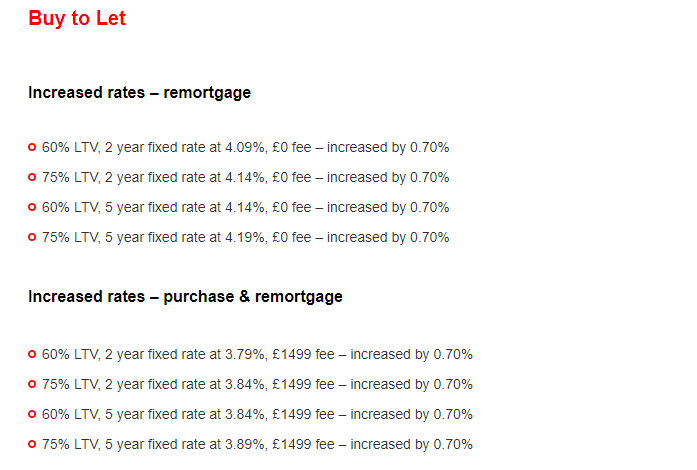

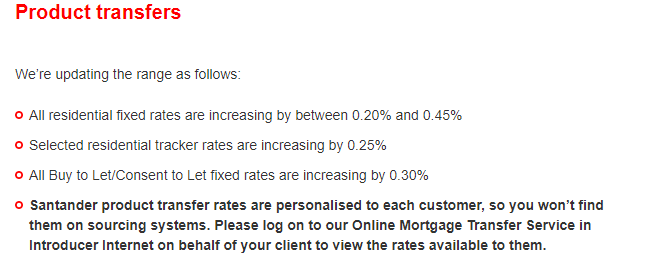

On Thursday 7 July we’re making increases of up to 0.70% to the majority of our new business rates, temporarily removing selected 85% LTV new business purchase and remortgage rates, as well as the £250 cashback on selected purchase products. Buy to Let rates will also be increasing by 0.70%. Plus, all residential and BTL product transfer fixed rates are increasing by up to 0.45% and selected residential tracker rates are increasing by 0.25%.

FMAs for products in Rate Bulletin (Issue 12) must be received by 10pm on Wednesday 6 July.

Working with you… 95% LTV mortgages

Maximum purchase price/value:

- £600,000 for non-new build houses

- £400,000 for non-new build flats.

We don’t lend on new build houses or flats up to 95% LTV.

The mortgage must be taken on capital and interest only

Minimum evidence requirements (employed applicants):

- Latest month’s payslip (or last four weeks’ payslips).

- Three months’ personal bank statements.

Self-employed applicants limited to

90% LTV.