View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Changes to our new business and product transfer ranges

On Tuesday 12 March, we’re launching a 95% LTV 2 year fixed rate for residential purchases. We’re increasing residential fixed and tracker rates in the new business and product transfer ranges. We’re also reducing other selected residential fixed rates for remortgage clients, and all Buy to Let fixed rates in the new business range.

There will be no change to large loan rates.

New business

- New 95% LTV 2 year fixed rate at 5.92% with no product fee and £250 cashback for residential purchases.

- Selected standard residential fixed rates reducing by between 0.08% and 0.23% for remortgages.

- Selected standard residential fixed rates increasing by between 0.06% and 0.43% for purchases and remortgages.

- All standard residential tracker rates increasing by between 0.01% and 0.32% for purchases and remortgages.

- All Buy to Let fixed rates reducing by between 0.09% and 0.23%.

Product transfers

- Selected residential fixed rates increasing by between 0.02% and 0.36%.

- Selected residential tracker rates increasing by between 0.02% and 0.14%.

- Buy to Let 5 year fixed rate increasing by 0.04%.

- For clients who want to change or cancel their new deal.

- If they haven’t accepted their product transfer offer yet, you can select a new product in the online mortgage transfer service for them and a new offer will be issued. Please make sure your client accepts the correct offer for the deal they wish to book.

- If they’ve already accepted their new deal, you can change to a different deal or cancel the one that’s already booked for them. You must do this at least 14 days before their new deal starts. Please see the ‘Product transfer cancellation process’ section on the Product transfers page.

- Whilst a product transfer is pending, your client cannot make any other changes to their mortgage until that new deal has started. This includes a switch to interest only for 6 months or a term increase under the Mortgage Charter, and other changes such as overpayments.

Monthly housekeeping

- Roll on of our new business benefit end dates by 1 month.

- Roll on of our new business and product transfer charge end dates and completion deadlines by 1 month.

- Completion deadlines have been rolled on to:

- 30 September 2024 for purchases

- 5 October 2024 for product transfers

- 7 October 2024 for remortgages.

- Product codes will be replaced across the new business and product transfer ranges.

Further information

- Full details of our new business range can be found in Rate Bulletin (Issue 8). You’ll find this on our Latest mortgage rates page from Tuesday 12 March.

- From Tuesday 12 March you can log on to our online mortgage transfer service in Introducer Internet to view your client’s choice of rates. You won’t find these on sourcing systems.

- You must submit your new business and product transfer applications on our current ranges by 10pm on Monday 11 March.

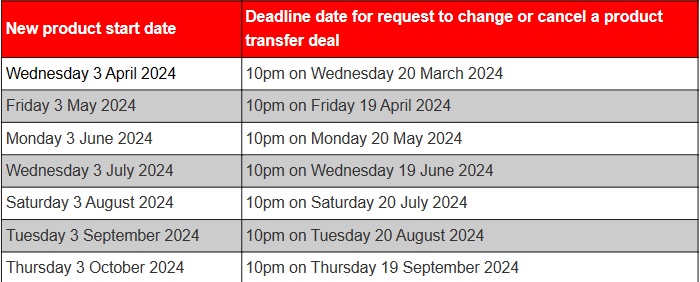

Upcoming deadline dates for changing or cancelling an accepted product transfer offer

We’ve added a new section to our product transfer page where you can find the current upcoming deadline dates for changing or cancelling an accepted product transfer offer. Please check your client is eligible to change or cancel their deal before submitting your request.

The current upcoming deadline dates for you to change or cancel a new deal are:

SFI – Introducer Internet downtime

Introducer Internet won’t be available from 9pm on Saturday 16 March until 6am on Monday 18 March.

Your brokers won’t be able to submit cases during this time. We’re sorry for any inconvenience caused.