View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

New business and product transfer fixed rate reductions

On Friday 8 December, we’re reducing selected residential and Buy to Let fixed rates in the new business and product transfer ranges.

New business and product transfer completion deadlines will roll on by 1 month. Please see the ‘Monthly housekeeping’ section below for more information.

New business

- Selected standard residential fixed rates reducing by between 0.03% and 0.32%.

- Selected New Build exclusive fixed rates reducing by between 0.15% and 0.20%.

- All large loan fixed rates reducing by 0.15%.

- Selected Buy to Let fixed rates reducing by between 0.03% and 0.18%.

Product transfers

- Selected residential fixed rates reducing by between 0.03% and 0.30%

- Selected Buy to Let fixed rates reducing by between 0.03% and 0.18%.

- For clients who want to change or cancel their new deal.

- If they haven’t accepted their product transfer offer yet, you can select a new product in the online mortgage transfer service for them and a new offer will be issued. Please make sure your client accepts the correct offer for the deal they wish to book.

- If they’ve already accepted their new deal, you can change to a different deal or cancel the one that’s already booked for them. You must do this at least 14 days before their new deal starts. Please see the ‘Product transfer cancellation process’ section on the Product transfers page.

- Whilst a product transfer is pending, your client cannot make any other changes to their mortgage until that new deal has started. This includes a switch to interest only for 6 months or a term increase under the Mortgage Charter, and other changes such as overpayments.

Monthly housekeeping

- Roll on of our new business charge and benefit end dates by 1 month.

- Roll on of our product transfer charge end dates and completion deadlines by 1 month.

- Completion deadlines have been rolled on to:

- 5 July 2024 for product transfers

- 28 June 2024 for purchases

- 5 July 2024 for remortgages.

Further information

- Full details of our new business range can be found in Rate Bulletin (Issue 30). You’ll find this on our Latest mortgage rates page from Friday 8 December.

- From Friday 8 December you can log on to our online mortgage transfer service in Introducer Internet to view your client’s choice of rates. You won’t find these on sourcing systems.

- You must submit your new business and product transfer applications on our current ranges by 10pm on Thursday 7 December.

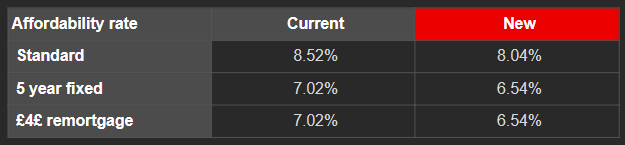

Residential and Buy to Let affordability updates

On Tuesday 12 December, we’ll be changing our residential and Buy to Let affordability rates.

Residential

We’re updating the residential affordability rates we use in our affordability calculation. This means most of your clients could borrow more.

Buy to Let

Our Buy to Let affordability rates will be reducing.

Please use our Buy to Let calculator on our website to get an accurate reflection of what we can lend your clients.

Pipeline rules

All full mortgage applications (FMAs) submitted by 10pm on Monday 11 December won’t be affected by these changes.

Any FMAs submitted from 6am on Tuesday 12 December will be assessed using our new lending policy.

If a material change is made to an existing application from 6am on Tuesday 12 December the case will be reassessed using our new lending policy.

Help and support

Our affordability and Buy to Let calculators and our Buy to Let lending criteria will be updated on our website on Tuesday 12 December.