View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Universal Credit and New Build update

Universal Credit

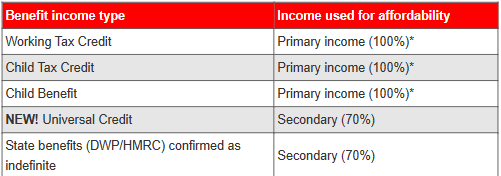

From Monday 18 March, Universal Credit will be an acceptable source of secondary income.

There are no other changes to our existing benefit income types.

*Income would be restricted to 70% for these benefits if they are paid as part of your client’s Universal Credit payment.

Eligibility

Your client must be in receipt of another source of earned income (employed or self-employed), and this must be evidenced on the Universal Credit award statement.

Evidence requirements

The following documents are required to evidence Universal Credit income. These can be found in your client’s Universal Credit online account:

- Proof of the last 6 months’ payments, and

- Latest Universal Credit payment summary with a breakdown of payments and deductions. The document must show all the sections as below:

- Entitlement

- Deductions

- Total payment for the month.

Please note we won’t accept bank statements as proof of income for Universal Credit.

Calculating Universal Credit income

We’ll take an average of the last 6 months’ payments minus the latest month’s housing benefit.

Please use our affordability calculator as it will automatically work out how much income we can use and calculate the net monthly income figure.

Help and support

Our affordability calculator and residential lending criteria have been updated.

New Build

We’ve added a new question in Introducer Internet > Agreement in principle to ask if the application is a new build purchase. If your client hasn’t yet found a property, please select ‘No’.