View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Product transfer window reducing from 6 months to 4 months

Background

Under the Mortgage Charter, lenders let their existing customers lock in a new deal up to 6 months before their current deal ends. We call this the retention window. In July 2023, we increased the retention window from just over 4 months to just over 6 months. This allowed customers to secure a lower rate earlier as rates were increasing rapidly at the time.

What’s changing?

As market rates have stabilised over the last few months and the Bank of England base rate is forecast to go down later this year, we’ve seen a very low percentage of eligible customers requesting a new deal between 4 to 6 months before their current deal ends.

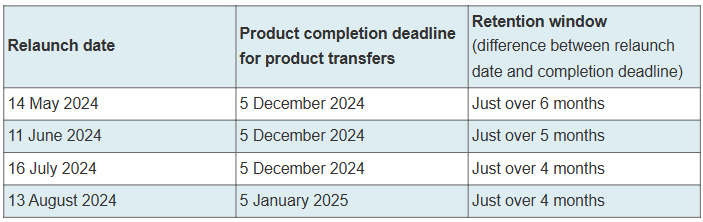

From Tuesday 11 June we’ll start reducing the retention window while still supporting the Mortgage Charter. We’ll do this by holding the product completion deadline for product transfer deals that we launch in June and July. The table below explains this.

So, for the time being only customers with a current deal ending up to and including 4 December 2024 will be eligible to secure a new deal. Then from 13 August relaunch, customers with a current deal ending up to and including 4 January 2025 will become eligible for a new deal. You should continue to access the online mortgage transfer service in Introducer Internet to check if your client is eligible to pre-book a new deal.

Our proactive customer communications

We’ve already sent a 6-month contact to customers with a deal ending up to and including 4 December 2024. From the beginning of September, we’ll start contacting customers with a deal ending up to and including 4 January 2025. This will be their first contact at 4 months before their deal ends.

What’s not changing?

- Customers can still change or cancel a pre-booked deal at least 14 days before it’s due to start.

- Whilst a product transfer is pending, customers cannot make any other change to their mortgage until the new deal has started. This includes a switch to interest only for 6 months or a term increase under the Mortgage Charter, applying for an additional loan, making an overpayment or starting the process to move home.

- If they already have an active Mortgage Charter change in place, the customer needs to call us directly on 0800 092 3881 if they want to request a new deal.