Announcement

Important updates to our products

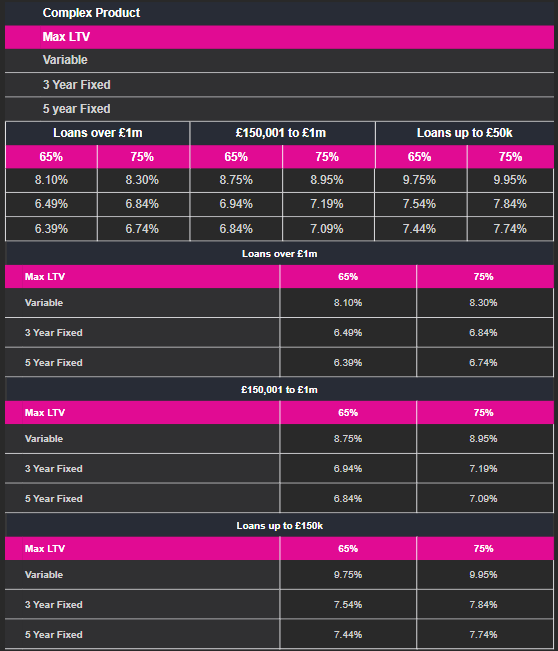

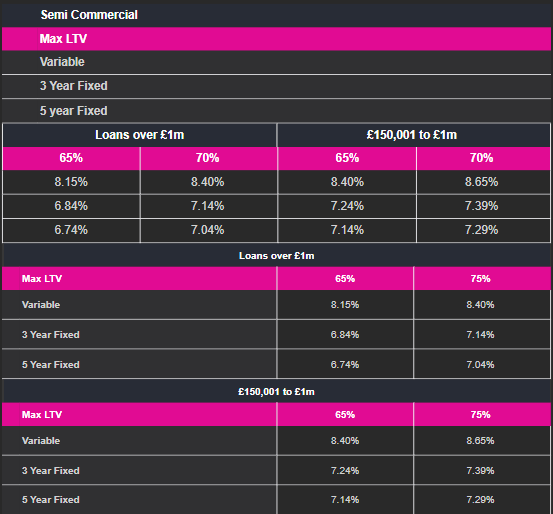

We are writing to inform you that due to rising interest rates over the previous few weeks, we will be increasing variable and fixed rates across our Complex Buy-to-Let, Commercial and Semi-Commercial product offerings.

We are also increasing our arrangement fee across all term products:

- New business fee: 3%

- Product switch and refinance fee: 1.50%

We remain committed to offering best in class lending solutions for professional property investors, and our doors remain firmly open to new and existing business to deliver your clients’ funding missions.

New rates and arrangement fees will be live from 5.30pm today (Friday 23 June 2023). Any cases submitted must include all applicant/company details, including those submitted prior to the changes going live. If this information is not provided, we will be unable to process the application.

Our National Relationship Managers are always on hand to guide your through these changes should you need any support. Please reach out to them with any queries you may have.

Pipeline

Pipeline cases will be honoured on the existing rates. As a reminder, all IMOs must progress to valuation within 14 days and all FMOs must be signed and return within 14 days in order to remain valid. Any cases that proceed outside of those timeframes, as published on the IMO and FMO documents, will proceed on the new rates (if applicable).

Buy-to-Let: Complex Product

Mortgages from £40k – £25m

Commercial Investment

Mortgages from £1m – £25m

Semi Commercial Investment

Mortgages from £500,000 – £25m

Reminder: scheduled maintenance to Broker Hub

This is a reminder that Broker Hub will be undergoing scheduled maintenance this Saturday 24 June, from 7am until 5pm and as such, the system will be unavailable during this time.

We apologise for any inconvenience this may cause.

We’re pausing new lending on second charge mortgages

We are writing to inform you that with immediate effect we are pausing new lending on our second charge mortgage offering.

We are reviewing a number of initiatives relating to our second charge mortgage proposition and will have more news for you soon, but in the meantime we are unable to accept any new applications.

We are honouring the application pipeline but the following timeframes must be adhered to:

- No Binding Mortgage Offers (BMOs) will be issued or re-issued after 5.30pm, Friday 7 July 2023

- All BMOs issued after today until Friday 7 July 2023 will have an expiry date of 26 July 2023

- All cases must complete before 5.30pm, Wednesday 26 July 2023. We will be unable to process any completions after this time

We apologise for any inconvenience that this may cause. If you have any questions, please do not hesitate to get in touch with our dedicated team who are on hand to support you