The Skipton Building Society has released an intermediary update. For full details see their latest product information here. All Skipton products are accessible through our direct to lender mortgage club with payment on completion. Contact us for details.

Breaking News! Brand new mortgage for renters

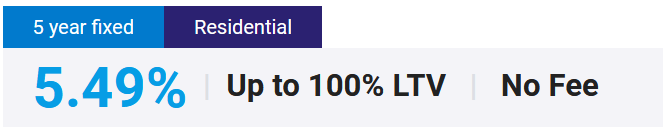

Track Record Mortgage for First Time Buyers

For too long, deposits have held back renters from becoming homeowners. With house prices and the cost of living rising, how can people be expected to pay their rent, keep up with bills and save 5 figure sums for deposits?

We think that needs to change. Which is why we’re putting our money where our mouth is with our brand-new Track Record mortgage – the first of its kind – where we look at a renter’s history of making rental payments, and if they meet affordability criteria they can access a mortgage without a deposit.

We think this could be the start of the great shift – turning generation rent into generation homeowner.

Key eligibility criteria

- Each applicant must be a First Time Buyer

- Each applicant must be aged 21 or over

- The same people who are renting now (and have been for the last 12 months) must be the same people on the mortgage (Exceptions apply – see our website for more information)

- Must have proof of having paid rent for at least 12 months’ in a row, within the last 18 months

- Must also have 12 months experience paying all household bills within the last 18 months

- Each applicant will have no missed payments on debts / credit commitments in the last 6 months

- The monthly mortgage payment must be equal to or lower than the average of the last 6 months rental cost

- The deposit must be less than 5%

- Maximum loan size £600,000

- Not available on New Build flats

Full eligibility criteria can be found on our website.

Please note that this product has limited availability and may be withdrawn at any time, without notice.

Bank of England Base Rate

Today the Bank of England’s Monetary Policy Committee announced a 0.25% increase to the base rate. The Bank of England Base Rate now stands at 4.50%. As a result of this announcement, we can now confirm the following:

All customers who have existing mortgages with Skipton Building Society which track the Bank of England Base Rate will see their account interest rate change (subject to any product rate cap) in line with their terms and conditions. For most Base Rate Tracker products, rates will be increased no later than 14 days from today, Thursday 11 May 2023.

The rates on our existing Base Rate Tracker mortgage products will continue to be available until 10pm Sunday 14 May 2023. The new rates reflecting the 0.25% Bank of England Base Rate increase will be available from 9am Monday 15 May 2023.