Below is an update from West One, the Bridging, BTL, Commercial, and Seconds Mortgage lender, that you can access via our specialist mortgage team. Contact our team today for more information.

Announcement

RESIDENTIAL MORTGAGE RANGE – INTRODUCTION OF 90% LTV AND MAJOR CRITERIA AND PRICING CHANGES

To get 2024 off to a great start we are delighted to announce a series of major criteria and pricing changes with immediate effect.

NEW LOWER MORTGAGE RATES AVAILABLE FROM 5.69% & £500 CASHBACK NOW AVAILABLE FOR PURCHASES

Significant rate reductions throughout the range with 5 year fixed rates starting from 5.69% and 2 year fixed rates starting from 5.99%.

INTRODUCING OUR NEW PRIME PLUS HIGHER LTV PRODUCT UP TO 90% LTV

We have introduced a brand new Prime Plus product range to offer LTV’s up to 90% LTV for remortgages (including capital raising for debt consolidation) and purchases. This also includes first time buyers currently renting with at least 12 months rental history. Our higher LTV 5 year fixed rates start from 6.55%.

FIRST TIME BUYERS – EXTENDED PRODUCT RANGE NOW AVAILABLE

First Time Buyers will now be able to access our Prime Product Range as well as our higher LTI products over 5.0 times LTI through our Prime Plus Flex and Prime Flex products subject to meeting the eligibility criteria. These products are available to First Time Buyers currently renting with at least 12 months rental history.

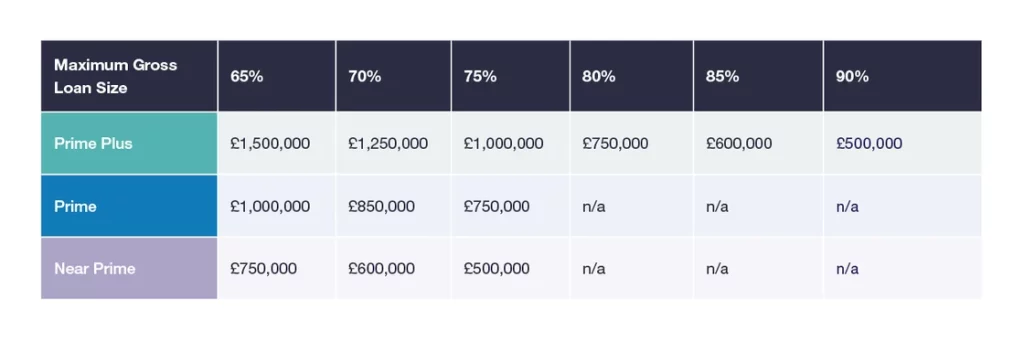

INCREASED MAXIMUM LOAN SIZES ACROSS THE RANGE & INTRODUCTION OF NET LTV’S

Our minimum loan size has been reduced to £25,000 across all products, and in addition to this all of our maximum loan sizes have been increased with a new maximum gross loan size of £1,500,000 up to 65% LTV.

We will now also exclude our lender fee from the LTV calculation up to a maximum gross LTV of 90%.

Full details of all our changes are available in our newly refreshed product guide dated 8th January 2024.