Below is an update from West One, the Bridging, BTL, Commercial, and Seconds Mortgage lender, that you can access via our specialist mortgage team. Contact our team today for more information.

Announcement

Residential Mortgages – INTRODUCING FEE ASSISTED MORTGAGES FOR SHARED OWNERSHIP AND RIGHT TO BUY PRODUCTS

We are excited to announce the launch of a brand new range of Shared Ownership and Right To Buy products which now include products with a “zero” lender fee

We are also making some changes to the credit eligibility rules for our Prime Plus Core Product, Prime Plus LTI Boost, Shared Ownership and Right To Buy Products.

These changes will be introduced from Wednesday 17th July 2024.

SHARED OWNERSHIP PRODUCT UPDATE

- NEW: “Zero” lender fee products now available up to 100% loan to share value with rates starting from 6.89%

- NEW: Fees associated with the mortgage can now be added to the loan up to 95% loan to share value (based on the gross loan detailed in our ESIS/Offer).

RIGHT TO BUY PRODUCT UPDATE

- NEW: “Zero” lender fee products now available with rates starting from 7.09%

- NEW: Lender fees (where applicable) can be added to the mortgage based up to the maximum LTV of 75% of the OMV

CREDIT PROFILE CHANGES

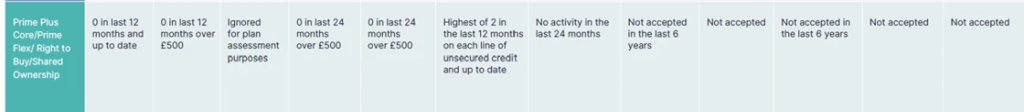

We are making some changes to the credit profile eligibility rules for our Prime Plus Core/ Prime PLUS LTI Boost/ Shared Ownership/ Right To Buy products.

- We will now allow the highest status of 2 in the last 12 months for unsecured credit (increased from 1 in the last 12 months)

- Satisfied CCJ’s over £500 will now need to be satisfied for 12 months to qualify for this plan

These changes take place with effect from Wednesday 17th July 2024. For any cases affected by our change to satisfied CCJ’s within the last 12 months, we will honour cases which have at least reached DIP approved status and the application is submitted by 31st July 2024.

Our latest product guide is now available below on the link:

Updated Product Guide – 15th July 2024

We would love to tell you more about West One has to offer and with more exciting changes to follow, please do get in touch if you would like to hear more about our residential mortgages products.

Second Charge Mortgages – IMPROVED SECOND CHARGE LTV’S, LOAN SIZES AND NEW LOWER RATES

We are delighted to announce some significant improvements to our second charge products.

NEW: INCREASED LTV’S

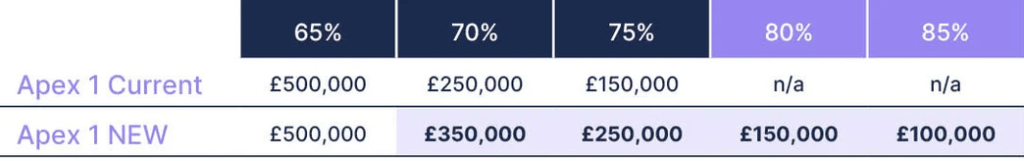

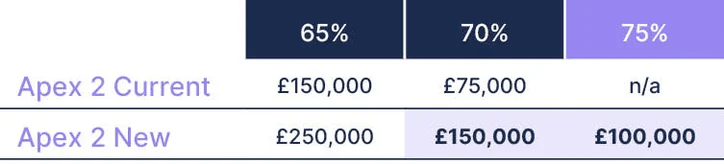

We have increased our LTV’s for Apex 1 and Apex 2 products

- Apex 1 LTV’s increased from 75% to 85% LTV

- Apex 2 LTV’s increased from 70% to 75% LTV

NEW: INCREASED LOAN SIZES

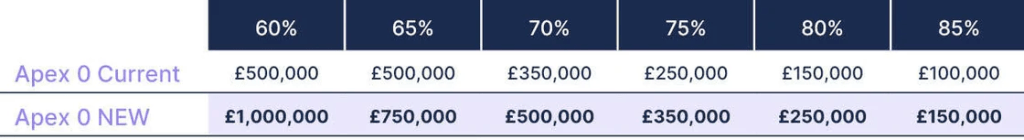

Loan sizes have been increased across our residential second charge product range, with loan sizes up to £1m now available:

NEW: LOWER RATES FOR APEX 0 CUSTOMERS

We have reduced a number of our Apex 0 rates with rate reductions up to 131 bps

Please find out up to date product guide below on the link:

Latest Product Guide – 16th July 2024

We have some more exciting changes to come in the next few weeks so keep an eye out for further updates!

Our helpful broker support team are available to offer dedicated support to our Specialist Distribution Partners.

Please do not hesitate to contact us should you wish to discuss a new enquiry and in the meantime thank you as always for your valued support.

Important Buy-to-Let Update: Important Product Changes

We are making changes to our 1st Charge Buy-to-Let fixed rate product range. The revised fixed rate product range will be available for selection on our broker portal from Monday 22nd July 2024.

The changes affect our Core and Complex product ranges.

A summary of some of the changes are noted below:

Product changes:

- Standard 5-year fixed rate reduced by 5bps – 15bps

- Standard 2-year fixed rate reduced by 20bps – 25bps

- Specialist 5-year fixed rate (Small HMO/MUFB) reduced by 10bps

- Specialist 2-year fixed rate (Small HMO/MUFB) & (Above or next to Commercial) reduced by 20bps – 25bps

- All W2 and W3 products reduced by 15bps and 10bps respectively

- 2-year fixed rates now starting from 2.84%

- 5-year fixed rates now starting from 4.29%

Criteria changes (Core range ONLY):

- Increase maximum loan size to £3 million gross on standard and specialist product ranges

- Ability to do foreign national cases where the borrower has no existing UK property. (LTV capped at 65% gross by referral)

- Ability to do expat cases where the borrower has no existing UK property. (LTV capped at 70% gross by referral)

A wide range of fee options are available across the product range, which are product specific, ranging from 2.50% to 9.99% which provides your clients with choice depending on their individual circumstances.

View Updated Product Guide July 2024

Service Levels

At West One we pride ourselves on speed of service and currently our SLA’s on BTL are as follows:

- Pre-submission referrals – dealt with within 2 hours

- Submitted Applications – fully underwritten and updated provided within 48 hours