Below is an update from West One, the Bridging, BTL, Commercial, and Seconds Mortgage lender, that you can access via our specialist mortgage team. Contact our team today for more information.

Announcement

Buy-to-Let Update: Important Product Changes

We are making changes to our 1st Charge Buy-to-Let fixed rate product range. The revised fixed rate product range will be available for selection on our broker portal from tomorrow Tuesday 21st May April 2024.

The changes affect our Limited-Edition and Core product ranges.

A summary of some of the changes are noted below:

Product Changes:

- Limited-Edition range reduced by up to 10bps

- Standard and Specialist Core products reduced by up to 15bps

- 2-year fixed rates now starting from 3.09%

- 5 year fixed rates now starting from 4.15%

A wide range fee options are available across the product range, which are product specific, ranging from 2.50% to 9.99% which provides your clients with choice depending on their individual circumstances.

New Product Guide:

An updated product guide incorporating these changes is available here

View Updated Product Guide 21st May 2024

Service Levels

At West One we pride ourselves on speed of service and currently our SLA’s on Buy-to-Let are as follows:

- Pre-submission referrals – dealt with within 2 hours

- Submitted Applications – fully underwritten and updated provided within 48 hours

Registration

If any of your colleagues would like to register to become an introducer to West One Buy-to-Let, please provide them with this link:

If you have cases to discuss or require any further information, please contact your BDM or the broker support team on 0333 1234 556 or email [email protected].

Residential Mortgage Update: New Lower Pricing & Improved Affordability

We are delighted to confirm that we are introducing new lower mortgage rates with effect from Wednesday 22nd May.

Our Prime Plus, Prime and Near Prime products will now include a 65% LTV option offering reduced pricing across our fixed rates and lifetime tracker products.

- 5 year fixed rates now starting from 5.87%

- 2 year fixed rates now starting from 6.35%

- Lifetime tracker products now starting from 2.30% above BBR

Our latest product guide can be downloaded here

Updated Product Guide – 22nd May 2024

Improved Affordability

We recently improved our affordability for borrowers taking out short term fixed rates and lifetime tracker products.

Why not see how West One can help your borrowers achieve their maximum borrowing potential?

- LTI of 5 times income as standard

- LTI Boost Products offering LTI’s over 5 times income where household income is at least £50,000

- Mortgage term’s available up to 40 years ending by the borrowers 85th birthday

- Latest year SA302 generally used for affordability

- Up to 100% of bonus and overtime can be included

- Debts being repaid with the mortgage proceeds are excluded from the affordability assessment

You can check out our affordability assessment by completing a maximum of 5 screens in our broker portal or you can check affordability offline by using our calculator:

Affordability Calculator – 2024

Hints and tips on using our calculator:

- Boxes in white allow you to enter figures or use the drop down boxes

- Boxes in blue repopulate based on the figures you enter in some of the white boxes

- If you are not seeing a “PASS” or “FAIL” please go back and check all the boxes have been completed

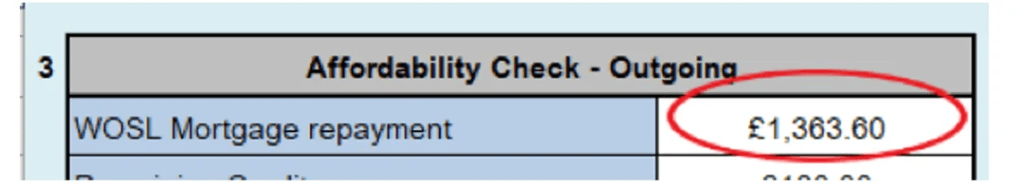

- Make sure you enter the mortgage repayment here:

Should you wish to discuss a new case or find out more about working with West One please get in touch with our dedicated broker team:

Email Us: [email protected]

Call Us: 0333 123 4556