See the latest announcement from TSB below. Note that you can access TSB via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

TSB Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

Mortgage Charter 10 July

From today, TSB has agreed to join the Mortgage Charter which has been set up by the UK’s largest lenders, the FCA, and the UK government to give borrowers more reassurance and support.

TSB has agreed on a set of standards to take when helping borrowers who are worried about higher rates.

Read TSBs FAQs and find out more by visiting TSBs Website.

Talking to us for information or guidance will not impact your customer’s credit file and can be the first step to finding a better solution.

If your customer needs help with their mortgage payments, or is behind with their payments, they can contact our Financial Support team on 0345 835 5404.

Brokers will be provided this information at 10:30am today, 10 July.

5 Year withdrawals 12 July and Product changes on 13 July

At 5pm today, TSB is withdrawing 5 Year Residential House Purchase and Remortgage products.

From Thursday 13 July, these will be re-introduced with the following changes to selected Residential, Product Transfer and Additional Borrowing ranges.

Rates increasing on:

Residential

- 2 and 5 Year Fixed House Purchase and Remortgage, by up to 0.55%

Product Transfer

- 5 and 10 Year Fixed Residential, by up to 0.60%

Additional Borrowing

- 5 Year Fixed Residential, by up to 0.45%

Bank of England base rate changes

Following the Bank of England base rate increase from 4.50% to 5.00% on 22 June, TSB has made the following changes to its products:

- Homeowner Variable Rate – 8.49%

- Buy to Let Variable Rate – 9.34%

- All Tracker rates increased by 0.50%

Brokers will be advised of these changes on Wednesday 12 July at 12:15pm and asked to submit existing applications for 5 Year Residential products by 5pm on 12 July. For all other product changes existing applications need to be submitted by midnight on 12 July, as they won’t be available after this time.

Improvements to lending criteria 13 July

From Thursday 13 July, TSB is making significant improvements to its lending criteria by increasing its maximum Residential income multiple to 5.50 times income, whilst also increasing its maximum loan to value for New Build main residence houses and bungalows to 90%. A welcome return to this sector of the market.

Good news for both new and existing borrowers.

Maximum loan to income changes

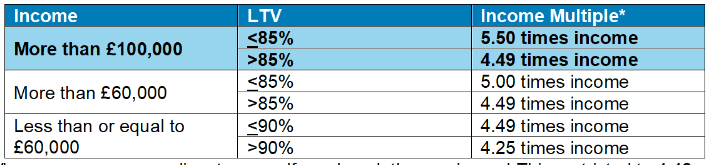

For employed customers earning more than £100,000 per application, the maximum loan to income multiple is now 5.50 times income (< 85% LTV) and 4.49 times income (> 85% LTV). See the table below for full LTI details.

*Where one or more applicants are self employed, the maximum LTI is restricted to 4.49 times income

New Build maximum loan to value changes

Maximum LTV for New Build main residence houses and bungalows has increased from 85% to 90% (subject to credit score)

Pipeline applications and DIPs

- Maximum loan to income changes – Cases started before 13 July will benefit from this change, should the application be amended, and the higher income multiple be required.

- New Build maximum loan to value changes – Cases started before 13 July will not be impacted by this change. Pipeline cases looking to increase the LTV to >85% will need to be resubmitted as a new application.

Brokers will be informed of the changes at 10.45am today (13th July).

Product withdrawals 13 July and Product changes on 14 July

From 5pm today, TSB are withdrawing its 5 Year Buy to Let range.

These products will be re-introduced on Friday 14 July with the following rate increases:

- 5 Year Fixed Buy to Let, House Purchase and Remortgage, by up to 0.50%.

Brokers will be advised of these changes on Thursday 13 July @ 2pm and asked to submit existing applications by 5pm on 13 July, as they won’t be available after this time.