View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Santander reducing fixed rates again on 2 July

On Wednesday 2 July we’re continuing to make fixed rate reductions to our new business FTB and home mover ranges. Following our new build affordability improvements, our FTB new build only range is reducing by up to 0.16%. Competitive highlights include our 85% LTV 5 year fixed rate with a £999 fee and £250 cashback at 4.21%. And the £0 fee equivalent is also reducing to 4.34% with £250 cashback.

We’re also reducing some 2, 3 and 5 year residential remortgage fixed rates by up to 0.10%. BTL purchase and remortgage fixed rates are reducing by up to 0.10%. There are no changes to our large loan rates or trackers.

For product transfers, most residential 2, 3 and 5 year fixed rates are reducing by up to 0.10%. There are no changes to tracker rates or BTL fixed rates.

Santander launching competitive remortgage fixed rates on 7 July

Our lowest remortgage rate will be a 60% LTV 2 year fixed rate at 3.84% with a £999 fee.

Plus we’re also reducing residential product transfer fixed rates.

There are no changes to home mover, FTB, new build, large loans, tracker rates or BTL fixed rates.

New business

Fixed rate reductions

- Residential remortgage – all 60-75% LTV 2 year fixed rates reducing by up to 0.16%. All 60-75% LTV 5 year fixed rates reducing by up to 0.10%.

Product transfers

- Residential – all 60-75% LTV 2 year fixed rates reducing by up to 0.13%. All 60-75% LTV 5 year fixed rates reducing by up to 0.10%.

- For clients who want to change or cancel their new deal:

If they haven’t accepted their product transfer offer yet, you can select a new product in the online mortgage transfer service for them and a new offer will be issued. Please make sure your client accepts the correct offer for the deal they wish to book.

- If they’ve already accepted their new deal, you can change to a different deal or cancel the one that’s already booked for them. You must do this at least 14 days before their new deal starts. Please see the ‘Product transfer cancellation process’ section on the Product transfers page.

- Whilst a product transfer is pending, your client cannot make any other changes to their mortgage until that new deal has started. This includes a switch to interest only for 6 months or a term increase under the Mortgage Charter, and other changes such as overpayments.

Further information

- Full details of our new business range can be found in the rate bulletin (issue 17). Our latest mortgage rates page will be updated on Monday 7 July.

- From Monday 7 July you can log on to our online mortgage transfer service in Introducer Internet to view your client’s choice of product transfer rates. You won’t find these on sourcing systems.

- You must submit your new business and product transfer applications on our current ranges by 10pm on Sunday 6 July.

Product transfer clients can choose

when their new deal starts

Our pledge to improve our product transfer process for you and your clients is something we take seriously and we hope you’re noticing the positive changes we’ve already made.

What’s next?

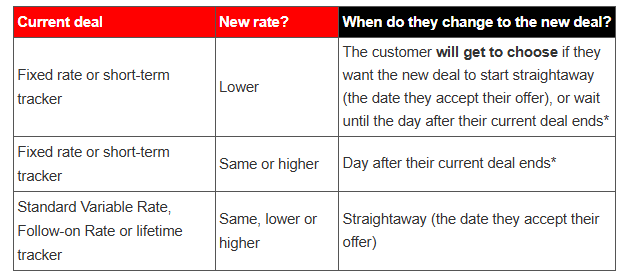

From Friday 4 July, when your client accepts a new product transfer deal that’s lower than their current one, they’ll get to choose when they want it to start.

*or the day before the completion deadline of the new deal, whichever is first.

If your client chooses to start their new deal straightaway, they won’t be able to change or cancel it. There’s no cooling off period.