Accord Mortgages have released an update on their product range, the details are set out below. Accord products are available through our direct to lender mortgage club so contact us for more information on how our club can support your business.

Applies to: Residential Product Transfer & Additional loans only

We’re making the following changes to our residential product transfer and additional loan ranges at 8am on Monday 1 February.

Rates going down

We’re reducing rates on 12 products at 65%, 75% and 85% LTV by up to 0.05%.

Rates going up

We’re increasing rates on 16 products by up to 0.10% in the 75% to 90% LTV tiers.

Deals not changing

46 products remain the same.

The current range of products will be withdrawn at 8pm on Sunday 31 January and the new products will available from 8am Monday 1 February.

Our full range of Product Transfer rates are available to existing Accord clients whose current deal is coming to an end or they’re mortgage rate is our SVR

And don’t forget we pay a competitive 0.30% proc fee for product transfers and additional loans over £3,000.

Brokers could get an offer and complete their client’s product transfer in just a few clicks using our online application process. We don’t require affordability assessments, valuations or credit checks for straightforward product switches.

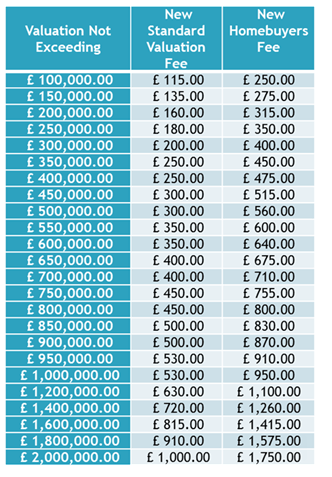

Accord BTL are reducing their standard valuation and homebuyers fees

Applies to: Accord BTL only

Accord are simplifying their fee structure by reducing standard valuation and homebuyers fees to align with their residential offering from 9am Friday 5th February.

Details of the new fees are below:

The change will take place over night on Thursday 4th February at 5pm to be live for 9am Friday 5th February, this does mean that their system will be unavailable from 5pm Thursday 4th February to 9am Friday 5th February.