Aldermore announced some product changes. See below for more information. For information on their current products and criteria call our team or click here. REMEMBER, you can access the Aldermore range using our Direct to Lender mortgage club so do contact us for further information.

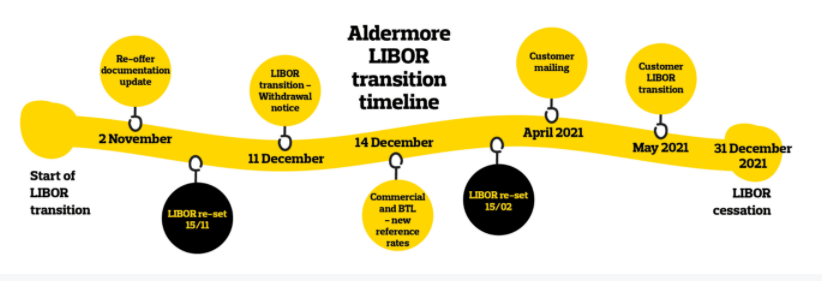

Important LIBOR linked product update

| With effect from Monday 14 December we’ll be relaunching our commercial and buy to let mortgage ranges. You’ll notice that LIBOR is being replaced by two new alternative reference rates. | ||||

| ||||

| Pipeline cases: We’ll continue to process any live pipeline cases as usual. If you have an active case or enquiry that has not yet been offered we will contact you during the underwriting process to advise you of the new comparable AMR/BBR linked rates to replace any LIBOR linked product you have currently selected. |

We’re reintroducing Help to Buy: equity loan residential mortgages

| We’ve relaunched our Help to Buy: equity loan scheme, helping your first time buyers get on the property ladder effective from today. We’re committed to supporting you and your clients and this range has been reintroduced to coincide with the recent government scheme changes. We’re pleased to confirm that we’ve launched the following new products Help to Buy: equity loan – 75% purchase only (£999 product fee) | ||||

| ||||

| Reverting to 4.58% (AMR + 0.00%) For full details of our current range, please see our residential mortgage guide. |

Aldermore mortgages: important changes to our application process

We’ve made some changes to our residential and commercial mortgage application process.

These changes will help us improve the way we review and process applications, so we can make quicker and better informed decisions for, you and your clients.

What’s changed?

When you submit a new application, we’ll now ask you to upload the documents we need to the portal at this new pre-full mortgage application (FMA) stage.

It’s really important that nothing is missed, as we won’t start assessing your case until we have everything asked for on the checklist.

Application will stay open for 7 working days, giving you time to upload the documents. If we receive an application without all requested documents or after the 7 day deadline, the case will be closed and you’ll need to resubmit the application.

When we have everything we need, the status of your application will change to ‘FMA Submitted’ and sit in our pipeline to be reviewed.

We’ll let you know if there’s any further documentation we need once we’ve reviewed your case.

When we receive your fully packaged application, our underwriters will now have all the information they need to start assessing your case.