Here are the latest updates from Barclays. These products are available via our direct to lender mortgage club which offers you payment on completion and a lot more besides!

Important Barclays Product Update

Following the product changes we announced yesterday, we can confirm that all of our products are available for sourcing to support your client conversations, however the following residential products won’t be available to select and submit in our application system until tomorrow, Thursday 11 February.

Purchase

- 2 Yr Fixed 2.87%, £0 product fee, 85% LTV

- 5 Yr Fixed 1.63%, £0 product fee, 60% LTV

- 5 Yr Fixed 3.08%, £0 product fee, 85% LTV

- Springboard 5 Yr Fixed 3.45%, £0 product fee, 95% LTV

- Springboard 5 Yr Fixed 3.65%, £0 product fee, 100% LTV

- Scotland Help to Buy 2 Yr Fixed 2.49%, £0 product fee, 80% LTV

- Scotland Help to Buy 5 Yr Fixed 2.59%, £0 product fee, 80% LTV

- Help to Buy 5 Yr Fixed 2.19%, £0 product fee, 75% LTV

- London Help to Buy 5 Yr Fixed 1.72%, £749 product fee, 55% LTV

Remortgage

- Great Escape™ 2 Yr Fixed 2.88%, £0 product fee, 85% LTV

- Great Escape™ 5 Yr Fixed 1.63%, £0 product fee, 60% LTV

- Great Escape™ 5 Yr Fixed 1.90%, £0 product fee, 75% LTV

- Great Escape™ 5 Yr Fixed 2.90%, £0 product fee, 85% LTV

Purchase & Remortgage

- 2 Yr Fixed 1.99%, £999 product fee, 80% LTV

- 2 Yr Fixed 2.63%, £999 product fee, 85% LTV

- 5 Yr Fixed 1.29%, £999 product fee, 60% LTV

- 7 Yr Fixed 1.49%, £999 product fee, 60% LTV

- Premier 7 Yr Fixed 1.49%, £749 product fee, 75% LTV

Product Transfer & Further Advance

- EMC Reward 2 Year Fixed 1.99%, £999 product fee, 80% LTV

- EMC Reward 5 Year Fixed 1.29%, £999 product fee, 60% LTV

- EMC Reward 5 Year Fixed 1.90%, £0 product fee, 75% LTV

- EMC Reward 7 Year Fixed 1.49%, £749 product fee, 75% LTV

We remain at 3 working days to assess applications and in the last 7 days, on average, we have answered your queries in under 3 minutes via our online Live Chat service, providing you with the quickest and most effective route to get the information you need, whether it be answers for new business queries or updates on existing applications

Mortgage product changes

As was the case throughout 2020, we will continue to work from the foundation of ensuring we provide you with a consistent level of stable service – whilst maintaining an extensive and competitive product range.

We remain at 3 working days to assess applications and in the last 7 days, on average, we have answered your queries in under 3 minutes via our online Live Chat service.

Last year we made a significant increase in the volume of colleagues available to support Live Chat, ensuring this provides you with the quickest and most effective route to get the information you need, whether it be answers for new business queries or updates on existing applications.

On the product front – we’re pleased to confirm we’re making another set of rate reductions across products within our Residential Purchase, Remortgage and Reward ranges, effective tomorrow, Wednesday 10th February, 2021

Key change highlights

These changes willl see us reduce a selection of our 2, 5 and 7 Year fixed Purchase and Remortgage rates ensuring each continues to remain competitive and well placed to support a wide range of your clients.

Key purchase rate change highlights

- Reduced – 3.06% 2 Year Fixed, £0 fee, 85% LTV – reducing to 2.87%

- Reduced – 1.76% 5 Year Fixed, £0 fee, 60% LTV – reducing to 1.63%

- Reduced – 2.67% 2 Year Fixed, £999 fee, 85% LTV – reducing to 2.63%

Key remortgage change highlights.

- Reduced – 2.08% 2 Year Fixed, £999 fee, 80% LTV – reducing to 1.99%

- Reduced – 2.95% Great Escape* 2 Year Fixed, £0 fee, 85% LTV -reducing to 2.88%

- Reduced – 1.34% 5 Year Fixed, £999 fee, 60% LTV – reducing to 1.29%

*Our Great Escape products come with a free non-disclosed valuation, free legals plus £250 cashback

These changes also include some further positive changes within our lower LTV Reward rates to support existing Barclays mortgage customers looking to switch their rate with a product transfer.

Key product transfer Reward change highlights.

- Reduced – 2.08% 2 Year Fixed, £999 fee, 80% LTV – reducing to 1.99%

- Reduced – 2.07% 5 Year Fixed, £0 fee, 75% LTV – reducing to 1.90%

- Reduced –1.62% 7 Year Fixed, £749 fee, 75% LTV – reducing to 1.49%

Please note some products are being increased. You can view our rate change overview and our new Intermediary and Reward rate sheets, for our range of new lending products, effective from tomorrow.

Key product change timings confirmed*

- Existing products: Final date for generating a Mortgage Information Sheet (MIS) Tuesday 9th February, 2021

- Last rate switch (product transfer) applications on existing Reward range products: Wednesday 10th February, 2021

- Last new lending applications on existing products: Thursday 18th February, 2021

__

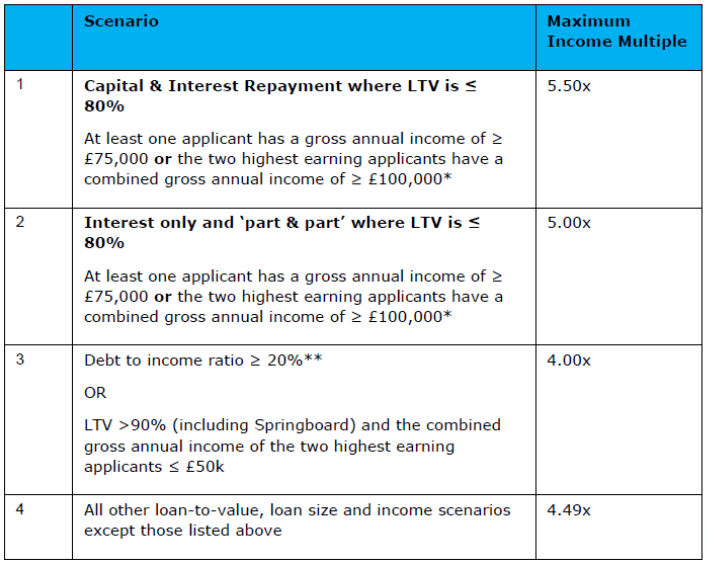

Improved Barclays Residential ‘Loan-to-Income’ multiples

We’re pleased to announce the launch of a new improved set of loan-to-income multiples for residential lending, effective today, Friday 5th February, 2021.

This means that from today, the following limits will automatically be applied when a residential lending decision is reviewed on a case, including on submitted pipeline applications.

Our improved loan-to-income multiples

* The income components considered when deciding if the minimum income threshold is met are: Basic income + sustainable allowances + self-employed income. ** Debt to Income ratio is calculated as monthly credit commitments after completion as a percentage of gross monthly income. |

Please click here to view our improved loan-to-income multiples Please be advised our lending policy and the affordability calculators on our website will shortly be updated to reflect the changes. |