Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

We’re updating our rates

In line with our commitment to give you two days’ notice of product closures, we will be closing products at 8pm Thursday 03 August.

We will be launching new products at 8am Friday 04 August.

Here’s what’s changing:

Residential (new business, porting, further advances, and product transfer)

- Reducing all Fixed rates (Incl. Offset, Interest-only and Offset Interest-only)

- Extending end dates across all products to February

Buy to Let (new business, porting, further advances, and product transfer)

- Increasing BTL existing customer only 2 Year Fixed 65% and 75% LTV no fee rates and 50% and 75% LTV £1999 fee rates

- Increasing Portfolio Landlord BTL existing customer only 2 Year Fixed 50% and 65% LTV £1999 fee rates

- Reducing all other Fixed BTL and Portfolio Landlord BTL rates

- Extending end dates across all products to February

New business cases

Remember, an AIP does not secure a closing product. If an AIP refers, we can’t guarantee we’ll be able to review it before the product is closed.

So, if your AIP does refer, you should copy the case and click through to full mortgage application to secure the product. Applications received after 8pm Thursday 03 August will not be accepted.

Product transfers

For product transfers the following will apply:

Online product transfer cases will need to be fully submitted by 8pm Thursday 03 August.

Product transfer paper application packs already provided need to be fully completed, signed by all applicants, and returned by 8pm Thursday 03 August.

Pending product transfer paper application packs and requests received between today’s date and 8pm Thursday 03 August need to be fully completed, signed by all applicants, and returned within 48 hours of the date of illustration.

We’re expanding our range

We’ve got good news for both your residential and Buy to Let clients. As the market shows signs of settling, and swap rates continue to drop, we’re pleased to reflect those changes across the majority of our mortgage range to support the market.

What you need to know

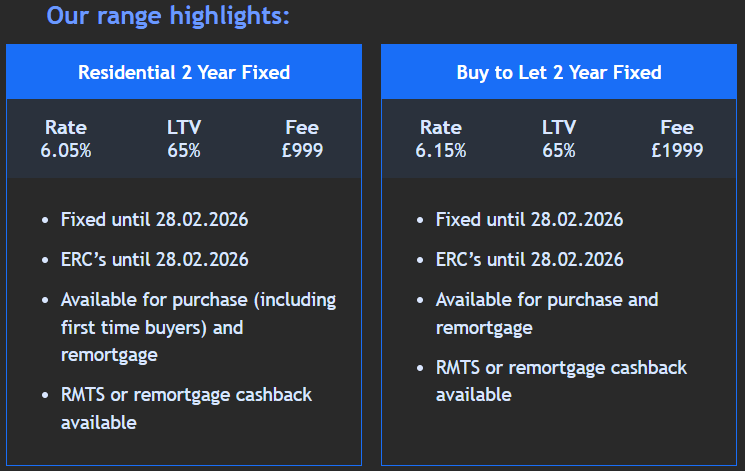

Residential updates

- Reduced 2 year and 5 year fixed rates (incl. Offset, Interest-only and Offset Interest-only)

- Reintroduced 3 year fixed rate products

- Reintroduced 65% LTV products

Buy to Let updates

- Reduced selected 2 year and 5 year fixed rates

- Reintroduced 75% LTV products

Plus…

We’ve extended all end dates across the entire range.

And finally, following our regular review, we’ve updated the ERC structure on all of our fixed rate products.