Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

Product updates

In line with our commitment, we’re giving you two working days’ notice of product closures

Closures will come into effect from: 8pm Monday 06 November

To secure a product, you’ll need to submit the application in full before 8pm on the closure date above. This applies to both new business cases and product transfers.

Any new products will be launched from 8am the date following closure.

Here’s what’s changing:

Residential

New Borrowers

- Reducing all 2 & 3 Year Fixed rates

- Reducing all 5 Year Fixed rates, excluding Purchase Fee rates at 75% LTV

- Reducing all 2 Year Fixed Offset, Interest-only, and Offset Interest-only rates

- Reducing all 5 Year Fixed Offset, Interest-only, and Offset Interest-only Remortgage rates

Existing Borrowers

- Reducing all 2 & 3 Year Fixed rates

- Reducing all 5 Year Fixed rates, excluding Fee rates at 75% LTV

- Reducing all 2 Year Fixed Offset, Interest-only, and Offset Interest-only rates

- Reducing all 5 Year Fixed Offset rates at 65% LTV

Buy to Let & Portfolio Buy to Let

New Borrowers

- Reducing all Fixed Remortgage rates

Existing Borrowers

- Reducing all Fixed rates

Remember – Pending product transfer paper application requests must be signed and sent back to us within 48 hours of the date of illustration.

There are no changes to our product range other than those listed.

We’ve reduced our rates

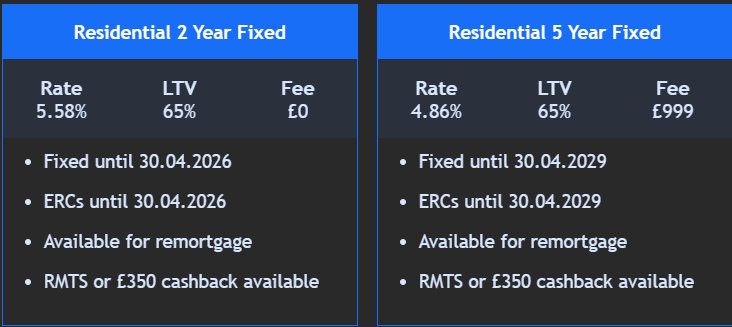

We have reduced all our 2 & 3 year fixed rates within our residential range, with selected 5 year fixed rates reducing too, for both your new and existing clients.

New products for first time buyers

Our 95% LTV range with 2 & 3 year fixed products have now launched for first time buyers and new purchase.

Changes have also been made to our BTL range as we’ve reduced all fixed remortgage and existing customer rates.

Our range highlights:

Check out our Buy to Let range

For your Buy to Let clients, see our BTL and Portfolio range here: