Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

Coventry for intermediaries supports first time buyers with policy changes

Coventry for intermediaries has made some important changes to its FTB lending policy, extending the definition of a ‘close relative’ for gifted deposits, and allowing first time buyers to apply for a mortgage before they’ve finished their probation period. The changes have brought the lender’s first time buyer policy into line with all its other Owner Occupier applicants.

Jonathan Stinton, Head of Intermediary Relationships says, “It’s a really challenging time to be taking that all-important first step on the property ladder, with rising house prices and the difficulties of saving for a deposit. We’re fully committed to supporting first-time buyers – we’ve significantly increased our lending in this area this year, and our new mortgage range will enable us to help more people buy their first home. Competitive rates, a range of LTVs and £500 cashback could make a big difference to those starting out on their journey as homeowners.

We’ve also brought our lending policy for first-time buyers in line with our policies for other Owner Occupier borrowers, like accepting FTB applicants who are still in their probation period. The same conditions will apply, so we’ll want to see that they’ve previously been employed in a similar role for at least six months, but the change means that we can consider more first time buyers for a mortgage with us, particularly as we’re seeing lots of people move into new roles with the economy opening up again.

And our First Home Saver, which gives a £500 to those saving to get onto the property ladder, is a much-needed boost for those becoming homeowners for the first time”

The eligibility of gifting a deposit now extends to wider relatives including aunts, uncles and

adopted children – and second charges will be allowed on any gifted deposit. Previously this

wasn’t an option for any form of residential lending.

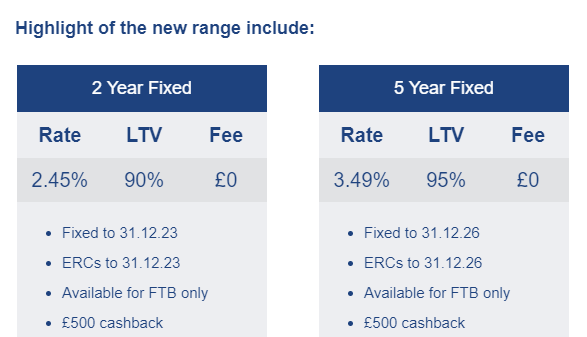

With a new FTB range including products up to 95% LTV, £500 cashback on completion and some fee-free options, Coventry for intermediaries offers more scope for first time buyers to secure their first home, even if their deposit is smaller.

Coventry Building Society has also launched First Home Saver, a savings account designed to help first time buyers (and their family members) put aside up to £1,000 a month for up to three years to build their deposit. If they then take out their first mortgage with the lender, they’ll benefit from a £500 celebratory bonus on completion.

You can see the FTB range and the new lending policy at:

https://www.coventrybuildingsociety.co.uk/intermediaries/products/ftb

First time buyers can also apply for any of Coventry for intermediaries’ standard residential products. You can see the full range at:

https://www.coventrybuildingsociety.co.uk/intermediaries/products/residential

We’re increasing our rates

True to our pledge to give you two working days’ notice of product closures, our latest changes will come into effect from 8am Friday 15 October.

Here’s what’s changing:

Buy to Let

- All BTL & Portfolio Landlord BTL product rates increasing

- End dates extending across all products

Owner-Occupied

- No changes to the range

Remember, an AIP does not secure a closing product. If an AIP refers, we can’t guarantee we’ll be able to review it before the product is closed.

So, if your AIP does refer, you should copy the case and click through to full mortgage application to secure the product. Applications received after 8pm Thursday 14 October will not be accepted.