Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

Product updates

We’re updating our rates

In line with our commitment to give you two days’ notice of product closures, we will be closing products at 8pm Wednesday 16 August.

We will be launching new products at 8am Thursday 17 August.

Here’s what’s changing:

Residential (new business)

- Withdrawing 3 Year Fixed new business rates at 90-95% LTV

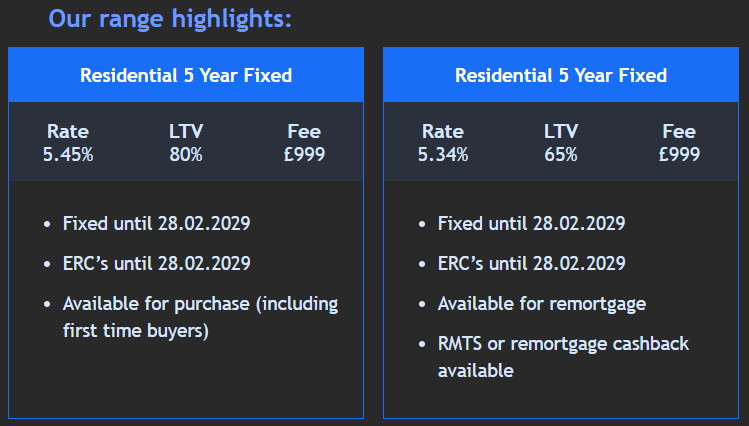

- Reducing all Fixed new business rates at 65-80% LTV (Excl. Offset)

Buy to Let (new business)

- Reducing 5 Year Fixed 65% LTV BTL/Portfolio Landlord BTL new business rates

New business cases

Remember, an AIP does not secure a closing product. If an AIP refers, we can’t guarantee we’ll be able to review it before the product is closed.

So, if your AIP does refer, you should copy the case and click through to full mortgage application to secure the product. Applications received after 8pm Wednesday 16 August will not be accepted.

We’ve reduced selected rates

With £111bn worth of residential mortgages and £15.8bn of Buy to Let mortgages set to mature before the end of the year*, now could be an ideal opportunity to reach out to your existing clients.

And that’s why we’re here to support. We’ve made several reductions across our new business residential and Buy to Let range, offering options for you and your clients.