Coventry have announced an intermediary update which is available below. Coventry and Godiva products are available through our direct to lender mortgage club so contact our team to find out how we can help you and our business with our mortgage support.

Product transfers – all you need to know

With the remortgage market offering a huge opportunity for brokers this year, it’s important not to forget about product transfers as an option for your clients.

And now, with the capability to submit a like-for-like product transfer online, it’s never been easier to switch with us.

Why might a product transfer be useful for your client?

- We reward loyalty. Our specific product transfer range offers lower rates than our new business range.

- You can complete like-for-like product transfers online to save you time.

- You can secure your rate early and still switch to another product if rates reduce any time prior to the maturity. Simply log back into MSO if you submitted it online and create a new illustration. This will replace the older one.

And, there are…

- No eligibility requirements

- No valuation fees

- No solicitor costs

View our product transfer range

Keep your eyes peeled as we look to launch further online services later in the year, and in the meantime, take a look at our product transfer range.

Need help?

You’ll find a whole host of FAQs here, and our dedicated Intermediary Support team are always on hand to help. You can call us on 0800 121 7788 or use our Live chat, and you’ll always speak to one of our human experts.

Help your clients reduce their energy costs with Green Further Advance

Lower mortgage rates for green home improvements

We’ve just launched our new Green Further Advance range, available with a maximum loan amount of £25,000. When your clients are ready to borrow more, they can benefit from a lower rate by making energy-efficiency improvements designed to reduce their energy bills and improve their property’s EPC rating.

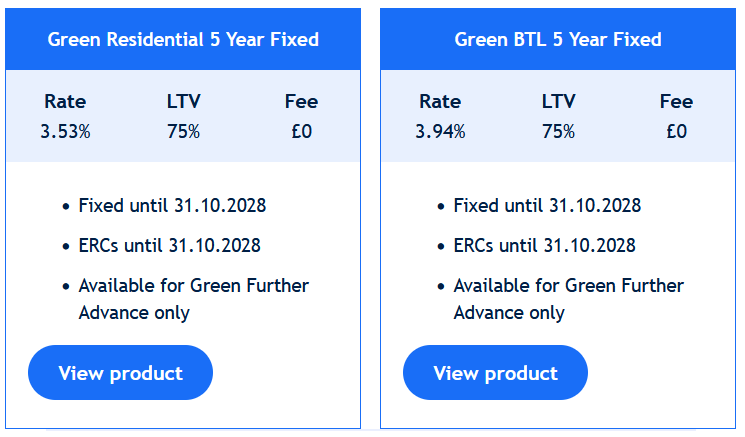

Our new range has product options available up to 90% LTV for Residential customers and 75% LTV for BTL customers, including Portfolio Landlords. Subject to availability.

How does it work?

The maximum loan amount is £25,000. At least 50% must be used for efficiency improvements – the rest must be used for any other type of home improvement.

Who can apply?

BTL and residential clients of Coventry Building Society and Godiva Mortgages Limited as long as they’re not on an Offset or Flexx for Term mortgage.

What’s covered?

A wide range of improvements, including insulation, window and door improvements and heating and energy installations.

Product highlights

Help your client generate a personalised efficiency plan

It’s easy to find out which improvements could make a difference to a property’s EPC rating and energy costs. Our new Home Energy Efficiency Tool estimates the current and potential rating of a building and generates some practical recommendations depending on budget.

And it doesn’t have to break the bank – even a simple change like insulating a hot water cylinder could save the average home around £70 a year*.

The Green Together Reward is no longer available for new applications but existing applications can be claimed up to 26 May 2024.

* https://energysavingtrust.org.