The Dudley mortgage range is available via our fees free specialist mortgage packager team or via our direct to lender mortgage club. Their latest product information is available here and their criteria details are available here (but is password protected so contact us or Dudley for further details).

Lender announcement

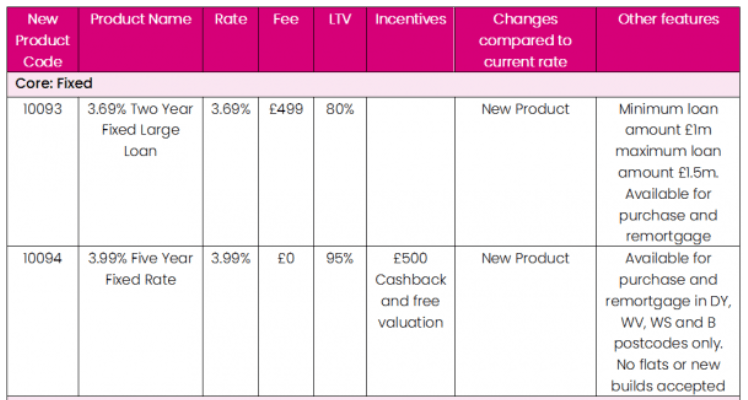

95% LTV and Large Loan products launched, with changes to our Further Advance range

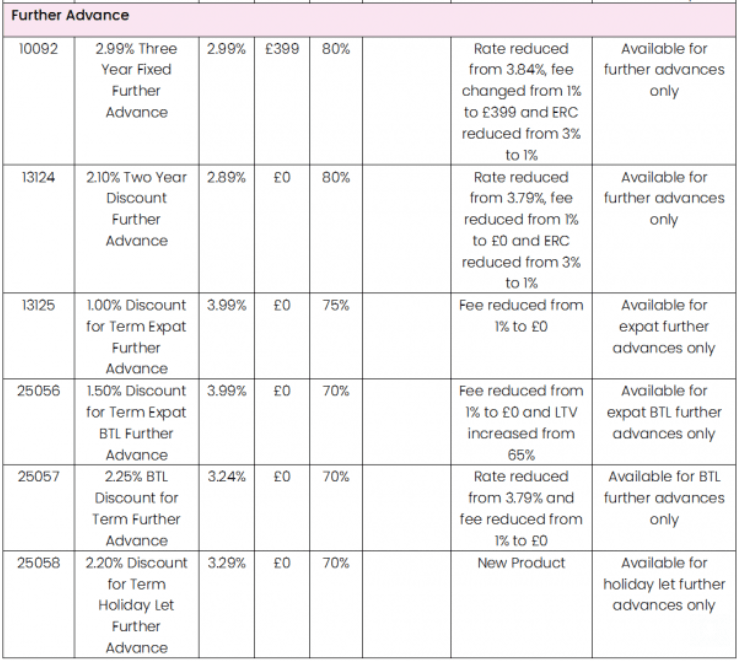

As housing market demand continues to rise, we want to ensure that we are providing your clients with a range of products which suit their needs. We are excited to announce that we have launched a 95% LTV product for locals and a mortgage for larger loans above £1 million. Our existing customers who are looking to borrow further funds, can also take advantage of our revised Further Advance range. Research by Money Broker Tools (MBT) shows that searches for 95% LTV mortgages have increased nearly eightfold since the start of 2021. Our core fixed range sees the introduction of a 95% LTV mortgage, with a maximum loan amount of £350,000, offering clients in our local area guaranteed monthly payments for five years. With £500 cashback, free valuation and no arrangement fee, our 3.99% Five Year Fixed Rate product is available for borrowers looking to purchase and remortgage in DY, WV, WS and B postcodes. To provide additional financial support, the Society will also pay for the higher lending charge on behalf of the borrower. Our new Two Year Fixed Large Loan product provides customers with a rate of 3.69% on loans between £1 million and £1.5 million. This fixed option has an arrangement fee of £499, offering purchases and remortgages to borrowers seeking a LTV of up to 80%. Five of our existing Further Advance products are being withdrawn and replaced with an improved range, which includes the introduction of a Holiday Let Further Advance product. For existing borrowers with Residential, Ex-Pat and Buy-to-Let mortgages looking to repair or improve their properties, interest rates and arrangement fees have been reduced. Early repayment charges on all Further Advance products are now 1% of the current balance, reduced from 3%. For full details and information on our lending criteria, please visit our website. |

We have withdrawn five of our Further Advance products. This includes the three-year fixed, as well as our discounted two-year, discount for term Ex-Pat, discount for term Ex-pat BTL and BTL discount for term products. Please note that we will accept full applications on these products for two weeks until Thursday 20th May. |