See the latest announcement from HSBC below. Note that you can access HSBC via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

HSBC Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

HSBC UK’s Intermediary Risk webinars – please join us:

We will be hosting a brand new CPD approved Mortgage Fraud prevention webinar, highlighting the current challenges in the industry, how to spot fake documents, AI scams, as well as discussing ‘tipping off’.

In addition, we will be continuing to run our Introduction to Mortgage Fraud webinar. Whether you were unable to attend a previous session, or you would simply like a refresh, please join us.

How to register

To register for one of the webinars, please click on your preferred option below and enter your details.

Once confirmed, please save the invitation to your calendar.

CPD approved Mortgage Fraud prevention:

New for 2024, this webinar will take a deep dive into Lender Intelligence, managing difficult conversations and documentation fraud, whilst also covering brand new case studies that have recently been submitted to HSBC UK.

Attendees must register and attend individually to receive their CPD certificate for this webinar. These details will then be used to issue your CPD certificate.

09:30am, Wednesday 24th January

CPD approved Introduction to Mortgage Fraud:

Continuing from 2023, our Intermediary Fraud team will be covering Mortgage Fraud, the latest industry trends, intelligence sharing and best practices, whilst also working through some real life case studies.

All webinars will last approximately 30 minutes.

We’re enhancing our residential lending policy

With effect from today, Tuesday 23rd January we will be making the following enhancement to our residential lending policy:

Part and Part mortgage loans

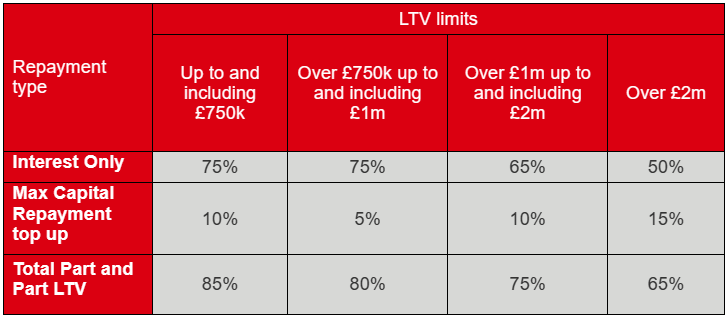

We are now able to provide your customer with the flexibility to submit a part Interest Only application with additional Capital Repayment, up to the maximum Part and Part LTV limit. For example, for a loan up to and including £750k, your customer can now have 75% on Interest Only and 10% on Capital Repayment, allowing them to have an 85% LTV on a Part and Part basis.

The table below shows the LTV limits and the different borrowing amounts for a Part and Part mortgage:

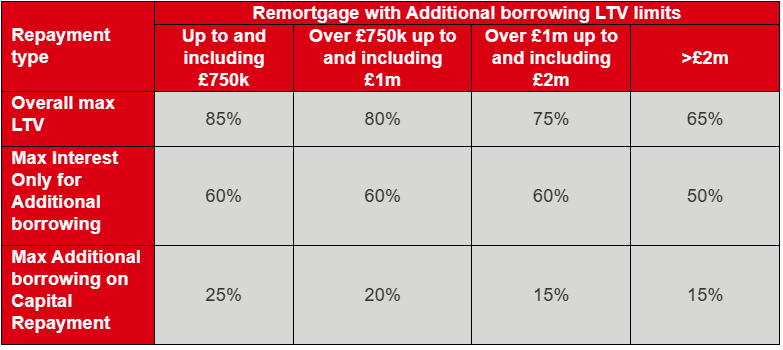

For Remortgages with Additional borrowing on a Part and Part basis, please refer to the below table for LTV limits:

*Where any aspect of the mortgage application is on an Interest Only basis the case will be subject to our standard Interest Only lending criteria and suitable repayment strategies.