Here is the latest release from Kensington. Remember we offer these products via Fees Free Packaging or direct to lender. For product details see their Residential Product Guide or their BTL Product Guide.

Interest rates have gone up… again

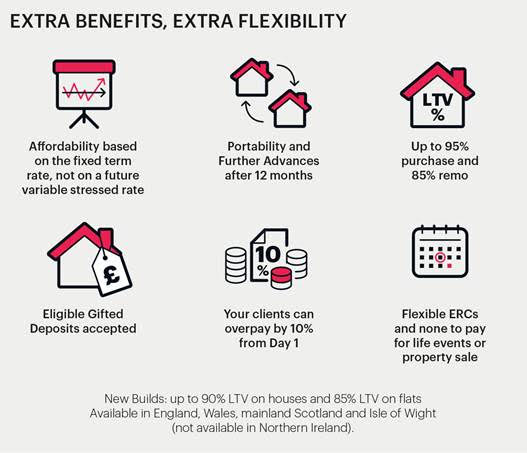

Following the fifth interest rate rise in six months, now is a good time to talk to your clients about our Flexi Fixed for Term mortgage. It offers a fixed term of 11 to 40 years (and anything in between) with a monthly mortgage payment that never changes. Key benefits include:

- 95% rates available from 3.85%

- Greater borrowing power

- No ERCs for life events

- Up to 95% LTV

- 10% overpay from day 1

Suitable for your FTB, remo or home movers, give your client the extra peace of mind that comes from knowing they won’t have to worry about fluctuating interest rates or remortgaging again.

Criteria Spotlight:

- This is a mortgage that offers your clients a chance to boost their borrowing power,

- allowing up to 6x LTI for first time buyers.

- Available up to 95% LTV, supporting borrowers with lower deposits.

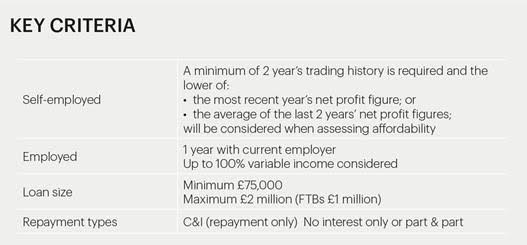

Credit criteria at-a-glance:

*Secured Loan Arrears and Defaults acceptable if older than 36 months.

*All Communications and Insurance defaults ignored.

*Utility defaults of £250 or less ignored.

Product Update

As of close of business Wednesday 22nd June we will be repricing our full range with the exception of Flexi Fixed for Term, full details will be available on Thursday morning.

Please note the submission deadlines below:

Decision in Principle Illustration produced and the FMA commenced by 5pm tomorrow

Full Application – submitted by 5pm on Tuesday 28th June.

View the product guides below for all current rates and details.

Please note, for applications from Northern Ireland, maximum LTV is 80% with £500k maximum loan size and no free legals apply.

Product Update

Please be aware that new products are now live, see the guides below for full details.

Don’t forget we also have our Flexi Fixed for Term range offering a fixed rate for up to 40 years, these products remain unchanged. Here are some highlights:

FFT: 75% LTV, 11-15 years, 3.30%, £1499 fee

FFT: 85% LTV, 11-15 years, 3.44%, £1499 fee

FFT: 90% LTV, 11-15 years, 3.63%, £1499 fee

To view our full range of products please see the product guides below.

Please note, for applications from Northern Ireland, these are subject to product availability, maximum LTV is 80% with £500k maximum loan size and no free legals apply.