Here is the latest update from Pepper Money. You can access Pepper Money products through our direct to lender mortgage club and get the benefits of payment on completion. You can also use our Fees Free Mortgage Packager.

Signatures on Standard Securities – Reminder

Please can we take this opportunity to remind you, that the Registers of Scotland are enforcing the Requirements of Writing Act 1995 in a prescriptive manner. This means that if a Standard Security document does not meet the statutory requirements, it will be rejected and our security will not be registered.

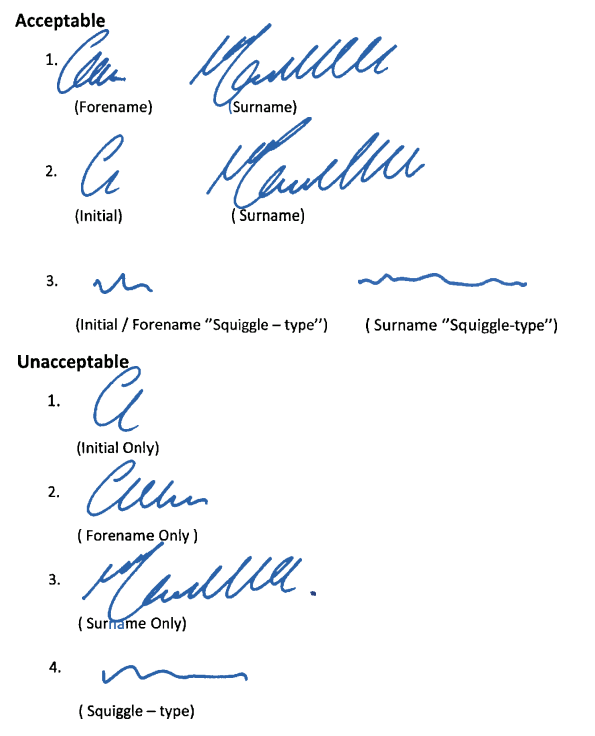

The statutory requirements state that a signature must comprise a surname preceded by a forename or initial. Anything that doesn’t meet this can be rejected, even if the signature in question is the borrower or the witness’ “usual signature”.

We have attached some guidance to assist you when speaking to your applicants on how the Standard Security needs to be completed. Any Standard Security received where we believe the signatures do not meet these requirements will need to be re-issued and re-signed.

This guidance only applies to Scottish applications.

Broker Bulletin 18th October 2023

Great news, we’ll now Offer with Consent to Follow.

Following our recent rate reductions, we’re speeding up the application journey for you and your customers. As the market-leading second charge mortgage lender, we’re always looking at ways to improve our service as part of our commitment to the seconds market.

To help us continue providing you and your customer with quick decisions, we’re pleased to announce that we can now issue mortgage offers with Consent to follow.

This change will reduce the time it takes for your customers to receive their mortgage offer. Plus, you’ll have greater certainty earlier in the process, which will reassure your customers they will be able to raise the funds they need to achieve their financial goals.

We’ll now issue the offer when Consent from the first mortgage lender is the only item outstanding subject to the following:

- The first mortgage lender must be listed below:

- NATWEST

- BARCLAYS

- SANTANDER

- HSBC

- LLOYDS

- NATIONWIDE

- PEPPER MONEY

- HALIFAX

- KENSINGTON MORTGAGE COMPANY

- LEEDS BUILDING SOCIETY

- CLYDESDALE BANK

- COOPERATIVE BANK

- YORKSHIRE BUILDING SOCIETY

- If ‘max libs’ confirmation is required, we will still need it BEFORE offer.

- We will not release funds until the Consent and Deed have been provided.