Covering Residential Mortgages, BTL, Secured Loans and Bridging Finance; all of the Precise Mortgage products are available via our specialist packaged team and our direct to lender mortgage club.

Coming soon – NEW Limited Company Buy to Let Conveyancer Panel

We’ll be launching our NEW Limited Company Buy to Let Conveyancer Panel on 23 October.

This pre-selected panel of over thirty conveyancers have a fixed-fee schedule in place, to provide your customers with a more consistent service and certainty over costs.

This change will apply to any new limited company buy to let applications submitted from 23 October.

The new panel only applies to limited company buy to let cases. Personal ownership buy to let cases can be dealt with by our core panel.

To find out more, speak with your Business Development Manager, call our dedicated support team on 0800 116 4385 or use Live Chat.

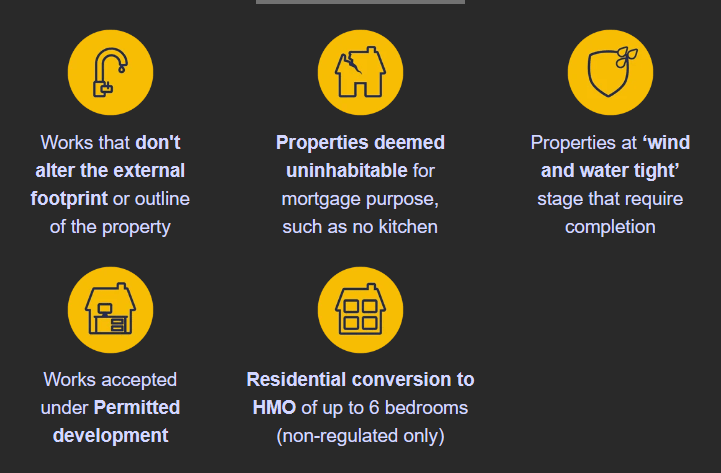

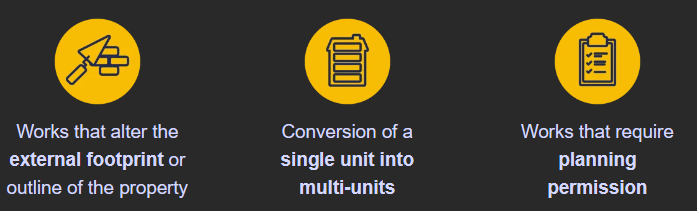

How our bridging finance range could help your customers

Our dedicated bridging underwriting team and Specialist Finance sales team are equipped to make the quick decisions needed for tight transaction deadlines.

- Up to 75% LTV available

- AVMs available up to 60% LTV, and with no fee

- No maximum loan amount

- Regulated and non-regulated

Standard bridging and Tier 1 refurbishment – Rates from 0.74%pm

Tier 2 refurbishment – Rates from 0.79%pm – LTVs up to 70%

Download our latest bridging finance product guide >>

If you have any questions, speak with your specialist finance account manager or call our dedicated underwriting team on 0800 116 4385.

Product changes

We’re making changes to our residential and buy let product ranges.

Residential:

- We’re lowering rates and introducing new 70% LTV products

Buy to let:

- Lowering the minimum loan on all products to £40,000

- Withdrawing our 4% product fee limited edition products

- Rolling the remaining limited edition products into our core range to replace existing 75% LTV products

New ranges will be available from 9am on Friday 20 October.

To secure a product from our current range you must fully submit your applications before 8pm on Thursday 19 October. We then need all minimum supporting documents uploaded by 5pm on Thursday 26 October.

For residential applications this includes:

- Signed Direct Debit mandate.

- Latest year’s accounts/tax calculation accompanied with corresponding

tax year overview (self employed). - 1 month from the latest 2 months’ payslips (net pay must be consistent

with bank statement) (employed). - The latest 3 calendar months’ personal bank statements showing

income and expenditure. - As part of the initial underwrite we may require additional documentation.

For non-portfolio buy to let applications this includes:

- Signed Direct Debit mandate plus any additional documents required as part of the initial underwrite.

For portfolio buy to let applications this includes:

- Signed Direct Debit mandate.

- Existing property portfolio form uploaded to the BTL Hub.

- Combined business plan, cash flow, and assets and liabilities form, along with latest months’ bank statement evidencing rent and mortgage payments.

- As part of the initial underwrite we may require additional documentation.

Full details of our document submission requirements can be found in our ‘right first time submission guide’