Covering Residential Mortgages, BTL, Secured Loans and Bridging Finance; all of the Precise Mortgage products are available via our specialist packaged team and our direct to lender mortgage club.

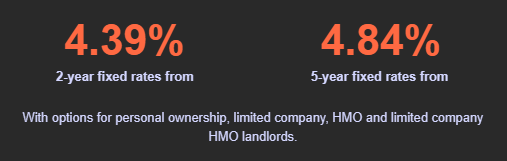

New buy to let products

Reduced rates

Don’t forget 2-year fixed and tracker rates now assessed at pay rate plus 1.55% (minimum 5.50%)

Limited edition >> Core range >> Specialist range >>

Speak with your business development manager who’ll always be happy to discuss case specifics prior to application. Alternatively get in touch using Live Chat or call our dedicated telephone support team available on 0800 116 4385.

Need a clear solution for adverse credit?

Our residential range could benefit those with adverse credit profiles and those who‘re struggling to secure a residential mortgage with a high street lender.

The maximum adverse we can accept includes:

- Defaults – 5 in 24 months

- CCJs – 3 in 24 months

- Debt Management Plans (DMPs) – Active and recently satisfied

- Unsecured arrears – Not counted but may affect credit score

- Mortgage, secured loan and rent arrears – 1 in 12 months, 3 in 36 months (worst status)

Take a look at our latest range >>

But that’s not all…

- Defaults and CCJs don’t need to be satisfied and there’s no upper limit on the value

- Historic pay day loans can be considered

- Active and recently satisfied DMP accepted with affordability based on the reduced DMP payment amount if the DMP will remain active after completion

To find out more, speak with your business development manager, call our dedicated support service on 0800 116 4385 or contact us using Live Chat.