View here for Santander’s latest announcements. Please remember that you can access Santander products, including semi-exclusive mortgages, through our direct to lender mortgage club which pays on completion. Contact us for more information. Visit Santander for Intermediaries website

Competitive residential rate reductions

On Tuesday 21 March, we’re making improvements to rates across our residential ranges.

Most new business fixed rates will reduce by up 0.28% and selected tracker rates by up to 0.34%. We’re launching a new 5 year purchase fixed rate at 3.99%, 60% LTV with a £999 fee. This is our lowest on-sale fixed rate along with the current remortgage version. At the same time, the 60% LTV 5 year fixed rate with no fee will be withdrawn.

For product transfers, selected residential fixed rates will reduce by up to 0.11%.

There’s no change to any Buy to Let rates.

Product transfers

Product transfer rates are tailored to each customer; you won’t find them on sourcing systems. Please log on to our online mortgage transfer service in Introducer Internet to view your client’s choice of rates. However, if you’re happy to use an estimated LTV, you can review what rates are available in the product transfer rate bulletin on our latest rates page from Tuesday 21 March.

Monthly housekeeping

- Roll on of our charge and benefit end dates by one month

- Completion deadlines have been rolled on to:

- 5 August 2023 for product transfers

- 29 September 2023 for purchases

- 6 October 2023 for remortgages

- Product codes will be replaced across the new business and product transfer range.

Further information

Full details of our new business mortgage range can be found in Rate Bulletin (Issue 6). You’ll find this on our website from Tuesday 21 March.

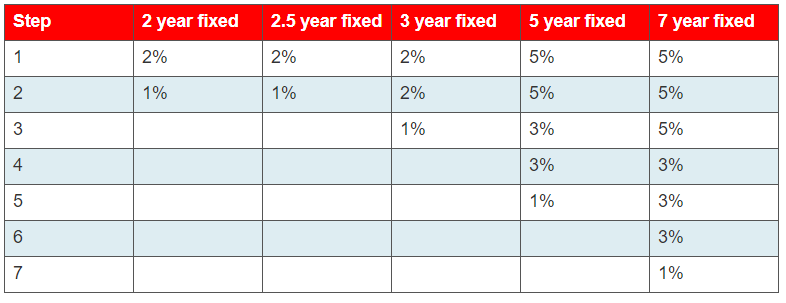

Reminder: stepped percentage early repayment charges

We’d like to reminder you that all fixed rate residential and Buy to Let full mortgage applications, plus product transfers now have stepped percentage early repayment charges (ERCs).

Our stepped percentage ERCs are below:

Further information

You’ll find full details of your client’s early repayment charge in their mortgage offer.

Response to the Bank of England base rate change

On Thursday 23 March, the Bank of England (BoE) base rate increased by 0.25% from 4.00% to 4.25%.

Following this decision, we can confirm the following for existing mortgage customers:

- Santander tracker products will increase by 0.25% from the beginning of May. Payments will change from 27 May onwards. This includes the Follow-on Rate, which will increase by 0.25% to 7.50%

- Alliance & Leicester tracker products will increase by 0.25% from the beginning of May and customers’ payments will also change from May

- The Standard Variable Rate (SVR) for both Santander and Alliance & Leicester is currently 7.25% and is under review. If we decide to change the SVR, we’ll publish the change on our website and write to all SVR customers.

If a customer’s existing mortgage is affected, they’ll receive a letter notifying them of their new interest rate and new monthly payment a minimum of 5 days before their monthly payment changes.

If they’re worried about how interest rate increases will affect their mortgage, they can find useful tools and tips in the ‘Bank of England base rate and your mortgage’ section of the Manage your mortgage page.

All tracker rates and reversion rates on our new business and internal transfer products will increase in line with the base rate on Tuesday 4 April.

Further information

- Any pipeline applications already submitted and/or offered are not affected so you do not need to do anything.

- Take a look at our base rate FAQs for more information.