The Skipton Building Society has released an intermediary update. For full details see their latest product information here. All Skipton products are accessible through our direct to lender mortgage club with payment on completion. Contact us for details.

Product Update

From Tuesday 21 March, we will be making changes to our Residential mortgage product range for Existing Customers and our Buy to Let fixed product range.

Key Changes

- Rate changes to our Residential Existing Customer range including the introduction of 70% LTV products.

- Withdrawal of 75% and 80% LTV Products from our Residential Existing Customer range.

- Rate reductions to our 5 year fixed Buy to Let range.

- New rates introduced to our 5 year fixed Buy to Let range including 70% LTV and £250 cashback products.

The product withdrawals will take place at 10.00pm on Monday 20 March. This also includes any current equivalent products, where the rate is being changed. Please see the updated Product Guide on our website for further details.

Criteria Update

Great news! We’ve enhanced our approach to Incentives on New Build. From Monday 20 March, we will be saying ‘yes’ to more New Build applications at 95% LTV.

Key Changes

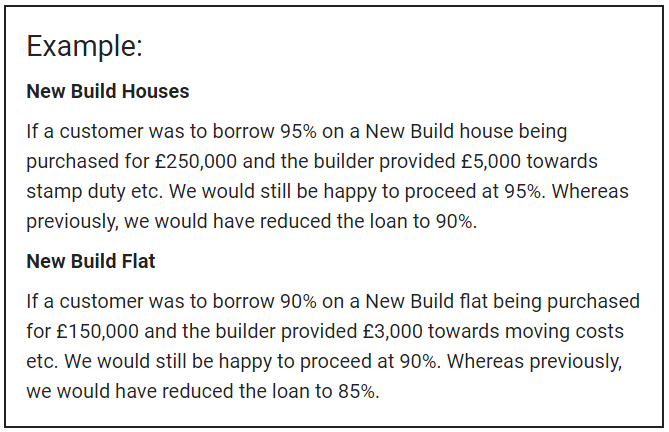

- Where the value of the financial incentive is up to 2% of the purchase price/valuation (whichever is the lower), there is no impact to the maximum LTV of 95% on New Build houses and 90% on New Build flats.

- If the value of the financial incentive is more than 2% of the purchase price/valuation (whichever is the lower) then the maximum LTV is reduced by 5%.

Bank of England Base Rate

Today the Bank of England’s Monetary Policy Committee announced a 0.25% increase to the base rate. The Bank of England Base Rate now stands at 4.25%. As a result of this announcement, we can now confirm the following:

All customers who have existing mortgages with Skipton Building Society which track the Bank of England Base Rate will see their account interest rate change (subject to any product rate cap) in line with their terms and conditions. For most Base Rate Tracker products, rates will be increased no later than 14 days from today, Thursday 23 March 2023.

The rates on our existing Base Rate Tracker mortgage products will continue to be available until 10pm Sunday 26 March 2023. The new rates reflecting the 0.25% Bank of England Base Rate increase will be available from 9am Monday 27 March 2023.