See the latest announcement from TSB below. Note that you can access TSB via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

TSB Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

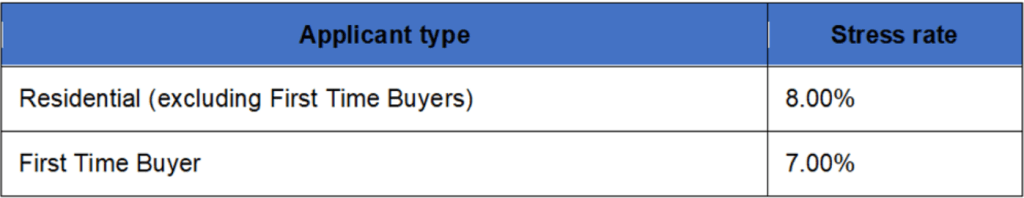

Important News from TSB: TSB makes changes to Residential Affordability criteria

From 4th October, TSB has changed the stress rates used when calculating affordability on Residential Mortgages.

This Move is due to market expectations of future interest rates.

IMPORTANT NEWS FROM TSB: Residential Product Withdrawals

From 4 October, TSB is making changes to the Residential range.

The lender is temporally withdrawing the following Residential products at 5pn.

- 10 year Fixed First Time Buyer, House Purchase and Remortgage Products

IMPORTANT NEWS FROM TSB: Product changes 6 October

From 6 October, TSB are making the following changes to their product ranges.

Residential

- Introducing 2 year Fixed First Time Buyer and House Purchase Products

- Introducing 5 and 10 year Fixed First Time buyer, House Purchase and Remortgage Products

Buy To Let

- 2 and 5 Year Fixed House Purchase and Remortgage, rates increasing by up to 1.60%

Product Transfer

- Withdrawing Residential and Buy to Let 2 and 5 year Fixed £995 fee products

- Withdrawing Residential 10 year Fixed £995 fee products

- Residential and Buy to Let Fixed, rates increasing by up to 1.20%

Additional Borrowing

- Buy to Let 2 year fixed tracker, rates reducing by up to 0.15%

- Residential and Buy to Let 2 and 5 year fixed, rates increasing by up to 1.20%