See the latest announcement from TSB below. Note that you can access TSB via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

TSB Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

IMPORTANT NEWS FROM TSB: Changes to lending criteria

From Tuesday 7 March, TSB is making changes to its lending criteria.

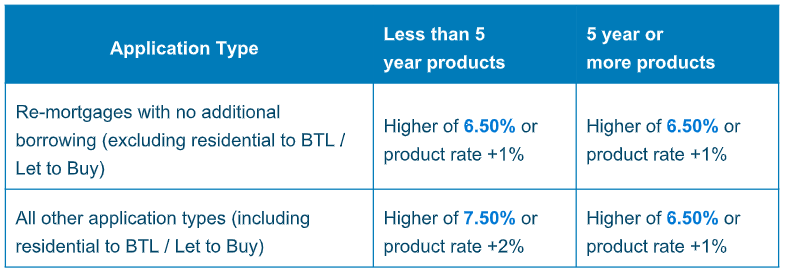

Buy to Let stress rate

- The stress rate applied to Buy to Let applications is reducing. Please see the table below for more information.

Stress rate for background Buy to Let mortgages

- The stress rate for background Buy to Let mortgages, on Residential mortgage applications is reducing from 7.00% to 6.50%.

Brokers will be advised of the changes on Tuesday 7 March at 10.30am.

Any DIPs or pipeline applications started before 7 March, won’t be impacted by these changes.

For more information please contact your National Account Manager.

IMPORTANT NEWS FROM TSB: Urgent product withdrawals

On Tuesday 7 March, TSB is withdrawing the following Residential and Product Transfer ranges at 1pm. Then on Wednesday 8 March, re-launching the withdrawn Residential and Product Transfer ranges with new rates.

Tuesday 7 March at 1pm, withdrawing:

Residential

- 5 Year Fixed House Purchase and Remortgage 0-85% LTV £995 fee rates

Product Transfer

- 5 Year Fixed 0-85% LTV £995 fee Residential rates

Wednesday 8 March, re-launching the following:

Residential

- 5 Year Fixed House Purchase and Remortgage 0-85% LTV £995 fee, up to 0.20% increase

Product Transfer

- 5 Year Fixed 0-85% LTV £995 fee Residential rates, up to 0.20% increase

Brokers will be advised of the changes immediately and asked to submit existing applications by 1pm on Tuesday 7 March as they won’t be available after this time.

For more information please contact your National Account Manager.