See the latest announcement from TSB below. Note that you can access TSB via the Brilliant Solutions mortgage club but the lender does place some restrictions on access. Contact us for details.

TSB Mortgage Product Guides are available here but check the date to ensure it has been updated to reflect the announcements below.

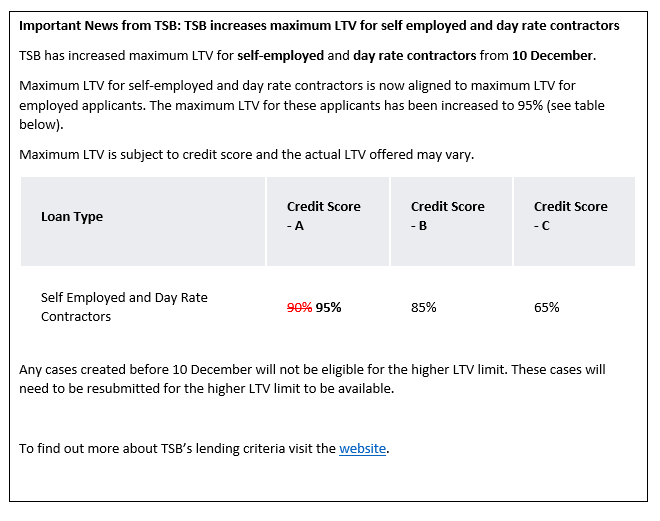

TSB increases maximum LTV for self employed and day rate contractors

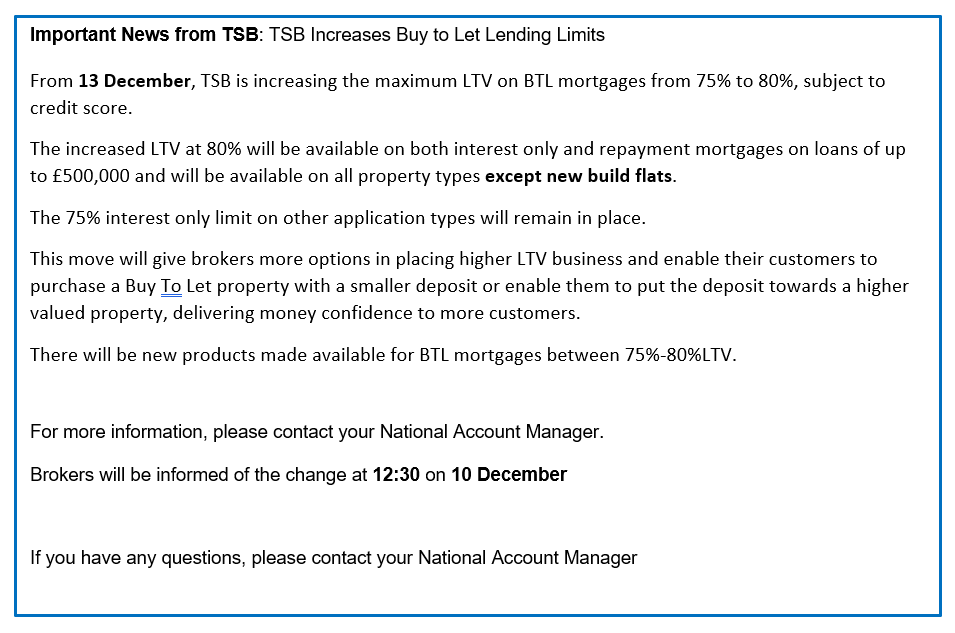

Increases Buy To Let Lending Limits

New Buy to Let 75-80% LTV products and changes to Residential and BTL range.

TSB has introduced new 75-80% LTV Buy to Let and Remortgage products

Introduction of new products:

Buy to Let

- 2 Year Fixed, 5 Year Fixed (3 Year ERC), 5 Year Fixed (5 Year ERC) House Purchase and Remortgage 75-80% LTV products.

Residential

- 2 & 5 Year Fixed (5 Year ERC) Remortgage 0-75% LTV, £995 fee products.

Temporarily withdrawn

- 5 Year Fixed (3 Year ERC) First Time Buyer, House Purchase and Remortgage.

- 5 Year Stepped Down First Time Buyer products.

Reduced rates on:

- 5 Year Fixed (5 Year ERC) First Time Buyer, House Purchase 80-90% LTV by up to 0.15%

- 5 Year Fixed (5 Year ERC) Remortgage 80-85% LTV by 0.15%

- 10 Year Fixed (10 Year ERC) First Time Buyer, House Purchase and Remortgage 60-80% LTV by up to 0.20%

Increased rates on

First Time Buyer/House Purchase

- 2 Year Fixed 0-80% and 85-90% LTV by up to 0.15%

- 2 & 5 Year Fixed Shared Ownership 0-75% LTV by up to 0.30%

- 5 Year Fixed Shared Equity 0-75% LTV by 0.30%

- 5 Year Fixed New Build First Time Buyer Shared Ownership & Shared Equity 0-75% LTV by 0.30%

Increased rates on

Remortgage

- 2 Year Fixed 0-75% LTV with £0 fee by up to 0.10%

- 5 Year Fixed (5 Year ERC) 75-80% LTV with £995 fee by 0.10%

- 2 Year fixed Shared Ownership 0-75% LTV by 0.30%

- 2 and 5 Year Fixed Shared Equity 0-75% LTV by up to 0.50%

Buy to Let Remortgage

- 2 Year Fixed 0-70% LTV rates increased by up to 0.15%

Brokers will be informed of these changes on Thursday 9 December at 2.00pm and asked to submit applications for withdrawn products by 8pm on Sunday 12 December as they won’t be available after this time.