Vida Homeloans has updated its range across the direct to lender and packaged range. Brilliant Solutions offers fees free packaging across the range as well as direct to lender access with payment on completion. Vida’s rates are available here and details on Vida’s criteria is available here. For more information you can contact our team. LOGIN to Vida here

Reduced Rates across Residential and Buy to Let!

We’ve made significant rate reductions on both our Residential and Buy to Let ranges to help more of your customers to get life moving.

Rate Reductions Summary

Buy to Let

- Rates reduced by up to 85bps on our fixed products and across all tiers.

- Products available from 75% LTV – 85% LTV.

- New 75% LTV Limited Editions.

Buy to Let Limited Editions

New 75% LTV Limited Editions launched on our 5 year fixed range:

- 5 year Standard, Vida 36, 6% fee – 5.14%

- 5 year HMO/MUB, Vida 36, 6% fee – 5.34%

View Buy to Let Limited Editions >>

Residential

- Rates reduced by up to 55bps on our fixed products including Right to Buy and across all tiers.

- Product options include 75% LTV – 85% LTV.

We’ve enhanced our criteria….

Take a look at our Lending Criteria

We’ve recently made changes to our criteria.

Take a look below at some of our latest enhancements, including changes to our maximum term, age and lending into retirement.

- Maximum age – We’ve increased the maximum age we will lend to, from 70 to 80 years at the end of term.

- Mortgage Term – We have extended our maximum potential mortgage term from 40 to 45 years.

- Lending into Retirement – We can consider lending to an applicant’s 80th birthday based on their current income where all the following statements apply:

- Applicant is under 50 years of age

- Is more than 10 years from retirement

- Is contributing to a pension scheme

Additional applicants who do not meet these conditions can be considered, however, none of their income will be used for affordability. The repayment type must be on a capital & interest basis.

All applicants are subject to full underwrite.

Let’s get life moving for you and your customers.

Take a look at our lending criteria or download our criteria guide.

Rate Reductions across our Packager Products

As well as on our Standard range of products, we’ve also made rate reductions across Residential and Buy to Let on our Packager Exclusive Tier range, to help more of your customers to get life moving.

Residential

- Rates reduced on our 2 and 5 year fixed products, including Right to Buy on our Packager Exclusive range.

- Product options include 65% and 75% LTV

- Available on our Packager Credit Tier

- Cheapest rate of 7.64% available on our 5 year fixed Packager Tier at 65% LTV

Download the Residential Guide

Buy to Let

- Rates reduced on our 2 year fixed Standard Packager Exclusive range and 5 year fixed products on our Standard range including HMOs/MUBs products

- Products options include 65% and 75% LTV

- Available on our Packager Credit Tier

- Cheapest rate of 7.39% available on our 5 year fixed Packager Tier at 65% LTV

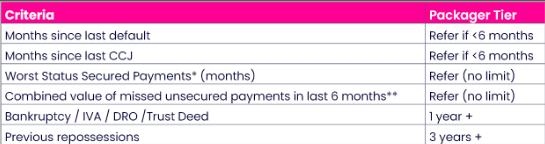

Take a look below as a reminder of the adverse criteria available on the Packager Tier:

*All historic secured arrears must have been made up to date for at least 6 months prior to application

**Telecom and Utility missed payments ignored when assessing adverse tier

Debt Management Plan/Debt Arrangement Schemes may be considered at Underwriter discretion – subject to satisfactory affordability and conduct checks.

Get in touch with our Packager Underwriters

If you would like to speak to us directly about any of your cases, please don’t hesitate to contact us!

Call 03300 246 246 and Press 6 for our dedicated Packager Underwriters, who will be happy to help you.

Alternatively, email [email protected] and one of the team will be in touch.