Furness Building Society have release a product update for intermediaries. See below for details. Access these product via our direct to lender mortgage club and get the benefits of payment on completion.

Announcement

1.79% Discount with no fee to pay

We’ve reduced the rate on our 2 year discount at 80% LTV – and there’s no fee!

Priced at 1.79% this discount is likely to rank highly against other 80% discounts and could work for your clients if they don’t want to pay a hefty fee when choosing a new mortgage.

We’ll pay your clients’ legal and valuation fees (subject to a maximum £1M valuation) in England and Wales. If your client is in Scotland, we’ll offer a legal fee contribution of £150.

Furness reduces 2 year fixed rates

The lender has repriced a number of its 2 year fixed rate products with a competitive edge across the

changes.

The lowest rate on offer with Furness is the 2 year fixed rate at 60% LTV priced competitively at just 1.09%,

with a £1,499 fee, which can be paid up front or added to the loan.

At 75% LTV the 2 year fixed rate sees a reduction of 10bps to 1.19% with a £1,499 fee.

A free legal and valuation package is available for standard remortgages in England and Wales with a

contribution towards legal fees in Scotland. Furness is also offering a free valuation on purchases with the

above products giving even more value for customers looking to save on home moving costs.

In the 80% LTV space Furness is offering another table topping, 2 year fixed rate at 1.69%, with a £1,250

fee. This one doesn’t quality for the free valuation on purchases but, as above, still attracts a generous legal

and valuation package on standard remortgages.

Alasdair McDonald, Furness for Intermediaries told us “Our product teams are working really hard to deliver

excellent value in our range of mortgages and we believe these products will source extremely well.

We’re hoping to see business coming in from our existing broker partners and those haven’t had a chance to place

lower LTV business with us previously. If you’ve not used us before, give us a try, we’ve got a great service

record and with easy access to our broker hub we’ll keep you in the picture every step of the way”.

The new products are on a repayment basis and are available across England, Scotland and Wales.

Product Withdrawal

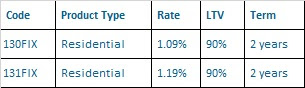

The following two products are being withdrawn at 5 pm on Friday 30 April 2021. To secure these products for your clients you need to either submit a full mortgage application or a DIP by 5 pm on Friday 30 April 2021.

After 5 pm on Friday 30 April we will only accept mortgage applications on these two products where a DIP was submitted to us by 5 pm on Friday 30 April 2021.

To see our current product range, including our 1.69% 2 year fixed rate for cases up to 80% LTV visit out website